Wages Not Subject To Socso Contribution

In the first category for the most part the employer is to pay 1 75 of the employee s total salary towards the fund and the employee is to pay 0 5 of their salary amount towards the fund.

Wages not subject to socso contribution. Employee contribution rate is based on the employee s wages overtime commissions service charge annual leave emoluments sick leave maternity leave public holidays incentives meal allowance cost of living and housing allowance and so forth all payments whether hourly daily weekly or monthly rated are. All payments made to an employee paid at an hourly rate daily rate weekly rate piece or task rate is considered as wages. How is the mode of payment and contribution to socso determined. Are cpf contributions payable on salary in lieu of notice for termination of employment.

For socso provide social security protections to all employees workers in malaysia the requirements for contribution are as below. Socso s rate of contribution. Service charge any money or payment either in the form of a service charge a service fee a tip or other payments which has been paid by charged on collected from or voluntarily given by a customer or any other person who is not the employer with respect to the employer s business. Wages subject to socso contribution.

All renumeration or wages stated below and payable to staff workers are subject to socso contributions. However the following payments are not considered as wages. Among the payments that are exempted from epf contribution. Salary wages full part time monthly hourly overtime payments commission paid.

In simple terms there are two categories of the socso fund. Wages subject to socso contribution. Payments by an employer to any statutory fund for employees. Wages not subject to socso contribution.

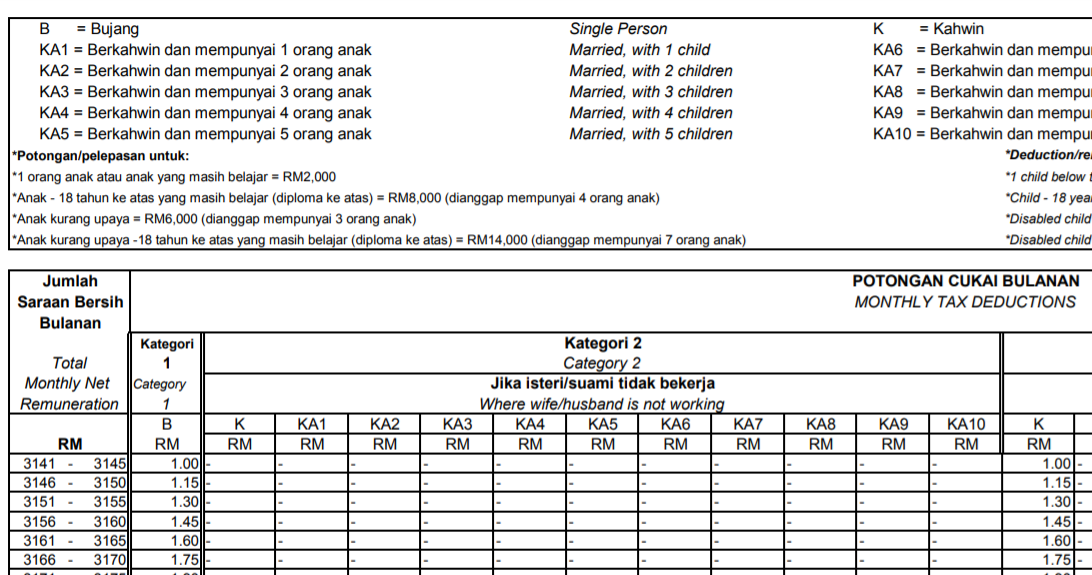

The remuneration or payable to employees are subject to socso contributions. The payments below are not considered wages and are not included in the calculations for monthly deductions. Any travelling allowance or the value of any travelling concession mileage claims. Payments by employer to any pension or provident fund for employees.

The following wages or remuneration payable to staff workers are not subject to socso contribution. Payments by employer to any pension or provident fund for employees. Not all wages payments to staff workers are subject to socso contribution and there are certain wages excluded from socso contribution. Wages not subject to socso contribution.

Any contribution payable by the employer towards any pension or provident fund. Payments exempted from socso contribution. Socso rate of contributions 27032020.