Income Tax Bracket Malaysia

How to file your taxes manually in malaysia.

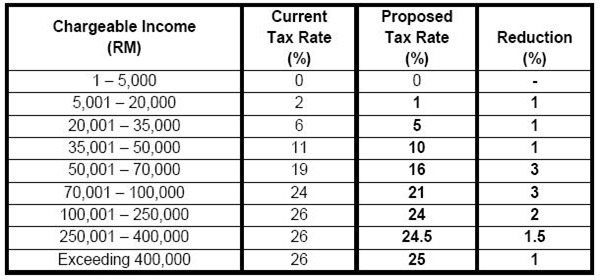

Income tax bracket malaysia. An individual whether tax resident or non resident in malaysia is taxed on any income accruing in or derived from malaysia. The personal income tax rates for 2018 2019 have been restructured and are different from previous year s rates. Income tax rates 2020 malaysia. This page is also available in.

Personal income tax rates. Tax offences and penalties in malaysia. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from rm1 640 to rm585. How to file income tax as a foreigner in malaysia.

An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. There are no other local state or provincial. Malaysia income tax e filing guide. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Overall income that is earned by household members whether in cash or kind and can be referred to as gross income. Melayu malay 简体中文 chinese simplified malaysia personal income tax rate. The last day to file the various income tax return forms has been extended by two months from the original deadline.

Below are the individual personal income tax rates for the year of assessment 2019 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia. As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs and deductibles available. In 2019 the average monthly income in malaysia is rm7 901 median household income. That s a difference of rm1 055 in taxes.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. No other taxes are imposed on income from petroleum operations. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. The inland revenue board irb in a statement tuesday march 17 announced that the move was to facilitate the submission of tax returns affected by the movement control order starting wednesday march 18 until march 31.

On the first 5 000. Calculations rm rate tax rm 0 5 000. On the first 20 000 next 15 000. How to pay income tax in malaysia.

According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes. Taxable income myr tax on column 1 myr tax on excess over.