International Financial Reporting Standards Ifrs Could Be Used By A Country By

The first step in understanding how the international financial reporting standards ifrs came into existence requires a stroll down memory lane back to 1973.

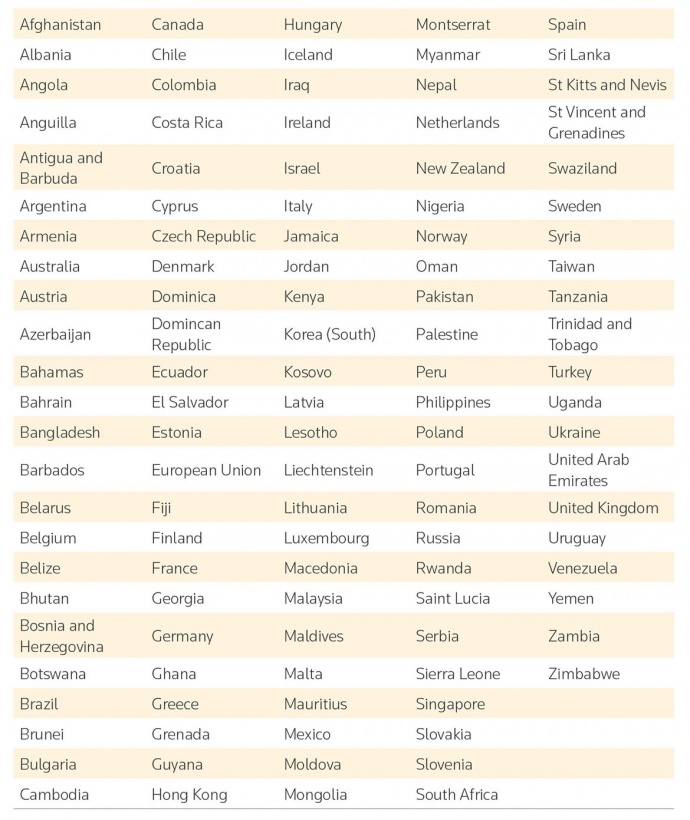

International financial reporting standards ifrs could be used by a country by. E all of the above. International financial reporting standards ifrs could be used by a country by a adopting ifrs as its national gaap. Others such as actuaries and valuation experts who are engaged by management to assist in measuring certain assets and liabilities are not currently taught ifrs and will have to undertake comprehensive training. International financial reporting standards ifrs.

International financial reporting standards ifrs could be used by a country by. To pave the way for a truly international financial standard a group of professional accounting bodies from 10 countries including the united states came together to form the international accounting standards committee iasc. T or f true international financial reporting standards ifrs are issued by the. The european union requires publicly traded member country companies to use ifrs international financial reporting standards.

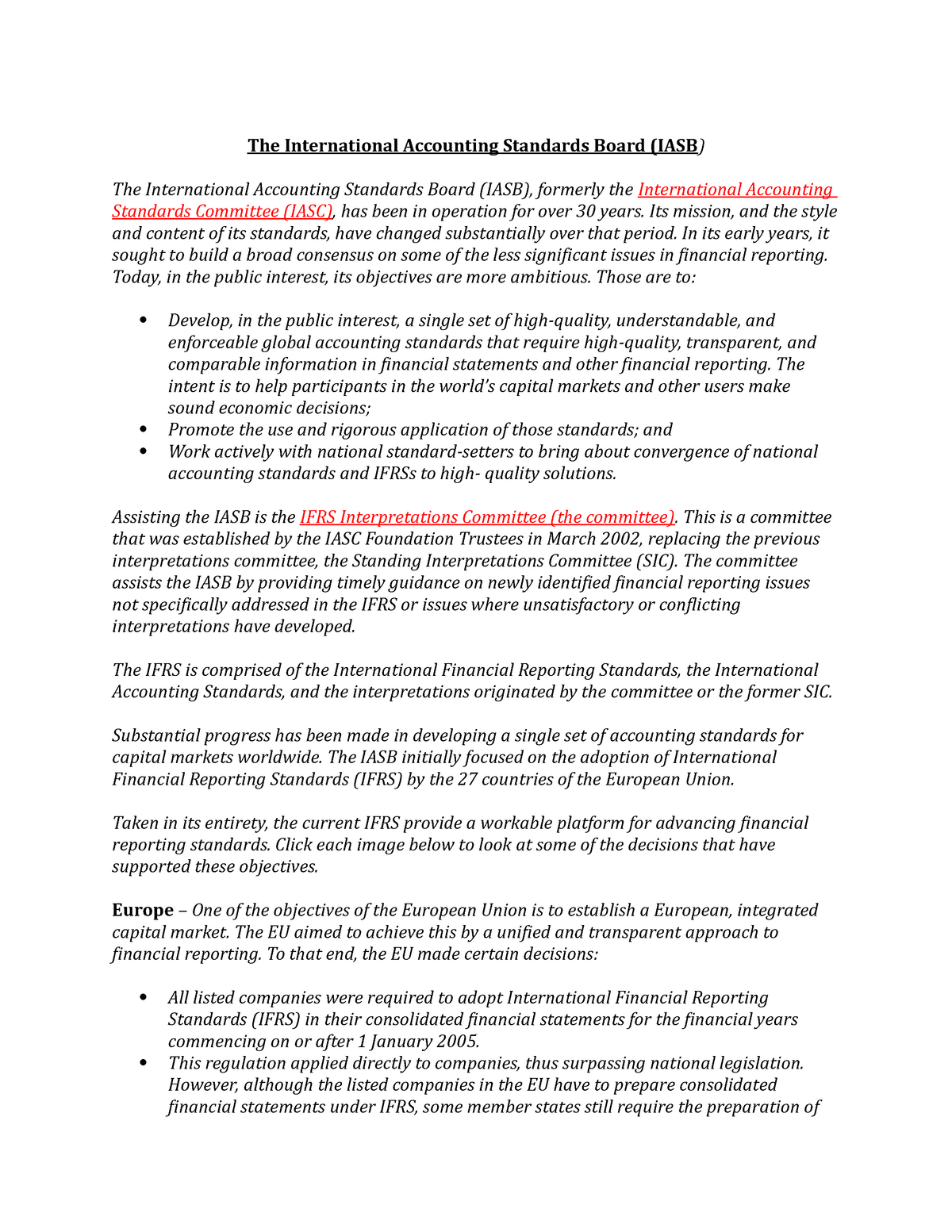

Widespread use of ifrs since 2005 provides an opportunity for empirical investigation of the benefits of ifrs. D requiring domestic listed companies to use ifrs in preparing consolidated financial statements. Ifrs adoption and endorsement in the eu. The international financial reporting standards foundation is a not for profit corporation incorporated in the state of delaware united states of america with the delaware division of companies file no.

A adopt ifrs as its national gaap b allow listed domestic companies to use ifrss c require or allow foreign companies listed on national stock exchanges to use ifrss d require listed domestic companies to use ifrs in the preparation of the consolidated financial statements e all of the above. 3353113 and is registered as an overseas company in england and wales reg no. Regulation ec no 1606 2002 of the european parliament and of the council of 19 july 2002 on the application of international accounting standards as a result of the regulation all eu listed companies were required to. Academic fellow research ifrs foundation.

This paper outlines the arguments for a common set of accounting standards and the forces that have promoted adoption of international financial reporting standards ifrs. C requiring or allowing foreign companies listed on domestic stock exchanges to use ifrs. On 19 july 2002 a regulation was passed by the european parliament and the european council of ministers requiring the adoption of ifrs.

/paper-with-title-international-financial-reporting-standards--ifrs---850740234-6e303822ed5e4800b523b0ac24db396c.jpg)