Epf Contribution Rate 2020 Table

Update maintain records.

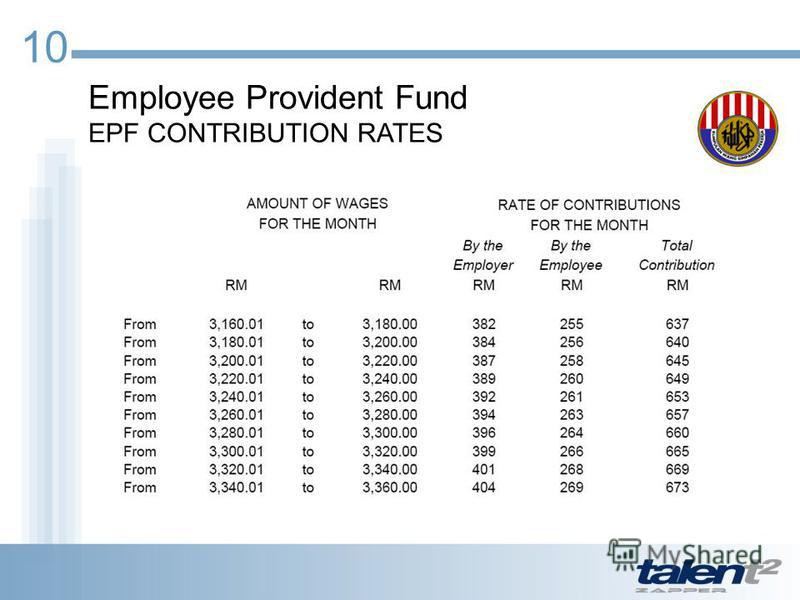

Epf contribution rate 2020 table. The establishments which were already entitled to reduced rate of contribution 10 through the so 320 e dated 09 04 1997 are not eligible for any further reduction in rate of contribution. The 7 contribution rate will take effect from 1st april 2020 until the end of 2020 and it will be applicable to all epf members under 60 years of age that are subject to statutory contribution. Employers are required to remit epf contributions based on this schedule. The minimum employers share of epf statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the employees share of contribution rate will be zero per cent.

The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download. Yes the rate of contributions is 10 for the three wage months may 2020 june 2020 and july 2020 irrespective of date of payment. The reduced employees provident fund epf contribution rate from 11 to 7 under the economic stimulus package 2020 will take effect in the employee s salary in april 2020 may. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12.

Cpf contribution and allocation rates p cpf contributions are payable at the prevailing cpf contribution rates for your employees who are singapore citizens and singapore permanent residents spr p. Notification dated 9th april 1997 was issued enhancing provident fund contribution rate from 8 33 to 10. Cpf contribution and allocation rates. With this 172 categories of industries establishments out of 177 categories notified were to pay provident fund contribution 10 w e f.

Employees provident fund malaysia epf is a federal statutory body under the purview of the ministry of finance employees provident fund epf will allow education withdrawals for professional certificate programmes under budget 2020 every company is required to contribute epf calculator for its staff workers and to remit the contribution sum to kwsp before the 15th day of the following. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule. 22 09 1997 onwards 10 enhanced rate 12.