Types Of Financial Institutions In Malaysia

1300 88 5465 bnmtelelink 603 2698 8044 general line bnmtelelink bnm gov my.

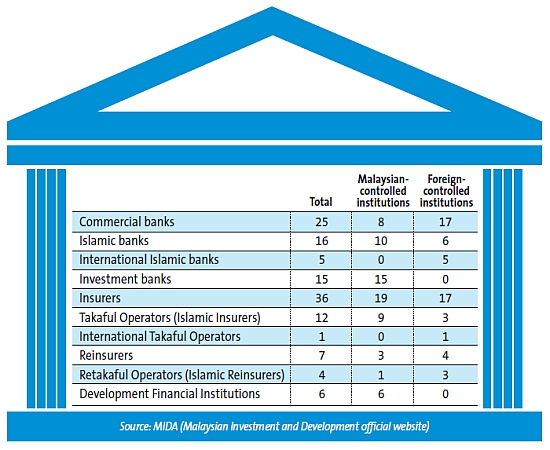

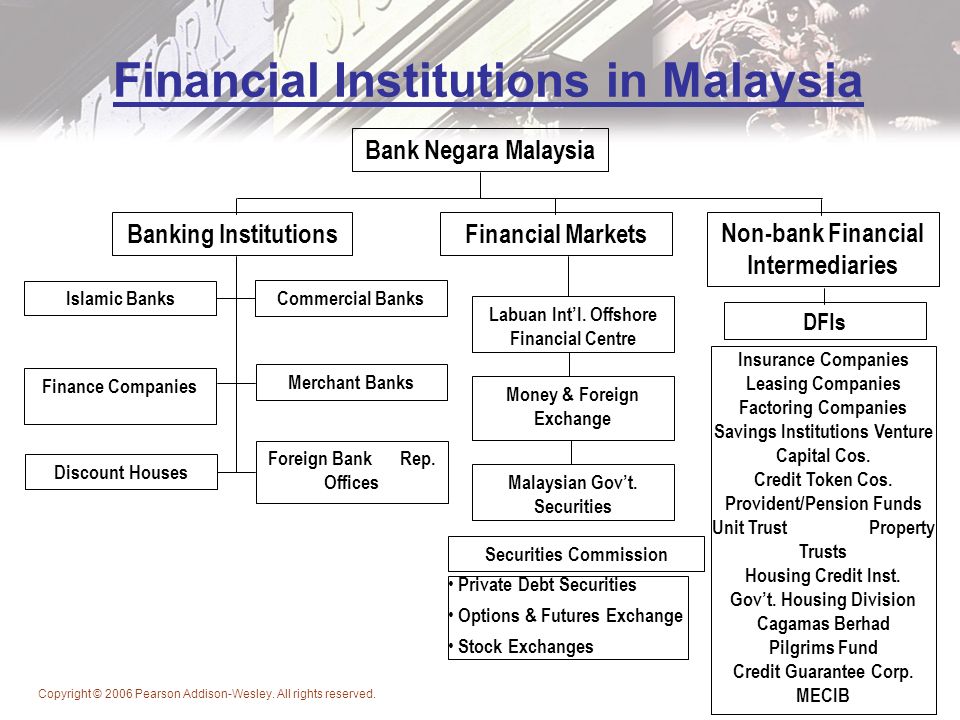

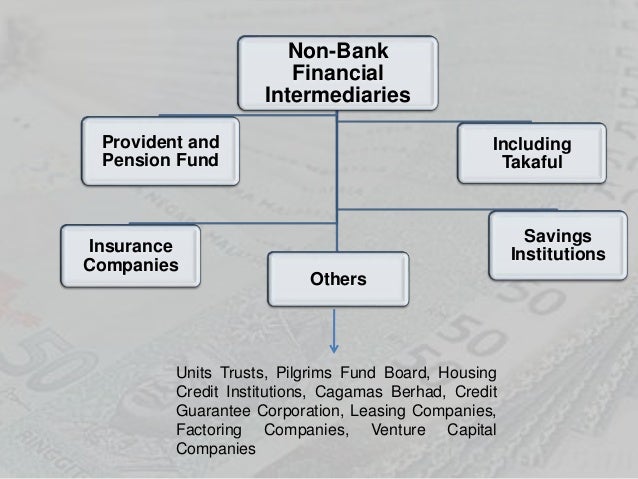

Types of financial institutions in malaysia. Bank negara malaysia 2. Types of financial institutions in malaysia free download as word doc doc docx pdf file pdf text file txt or read online for free. Provident and pension funds 2. Banking institutions commercial banks finance companies merchant banks islamic banks 3.

Pdf financial system of malaysia 5 1 financial system. Types of financial. Others discount houses representative offices of foreign banks 1. To know which financial institution is most appropriate for serving a specific need it is important to understand the difference between the types of institutions and the purposes they serve.

Governments of the country consider it essential to oversee and to regulate these institutions as they play an integral part in the economy of the country. The aim of this study is to. 1300 88 5465 bnmtelelink 603 2698 8044 general line bnmtelelink bnm gov my. Financial institutions are companies in the financial sector that provide a broad range of business and services including banking insurance and investment management.

Personal finance financial institutions malaysia types of financial institutions in malaysia. At the end clarification needed maybank has the largest capitalisation in malaysia in june 2018. Bank rakyat muamalat ocbc bank do not co brand their cards except for atm use only. The development financial institutions dfis in malaysia are specialised financial institutions established by the government with a specific mandate to develop and promote key sectors that are considered to be of strategic importance to the overall socio economic development objectives of the country.

As malaysia s central bank bank negara malaysia promotes monetary stability and financial stability conducive to the sustainable growth of the malaysian economy. Jalan dato onn 50480 kuala lumpur malaysia. Types of financial institutions banking system non bank financial intermediaries 1.