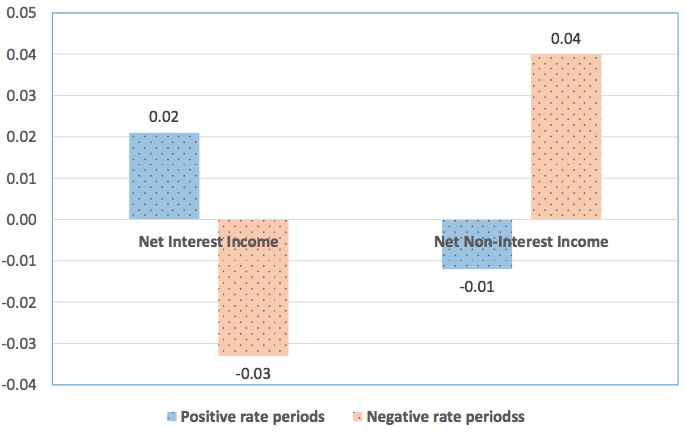

Net Non Interest Margin

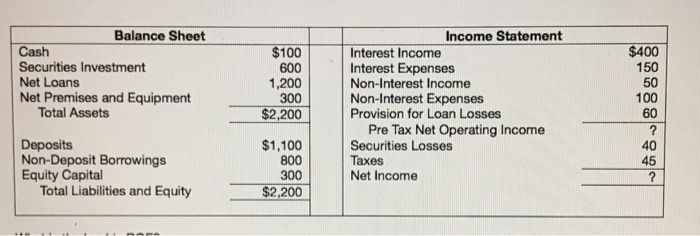

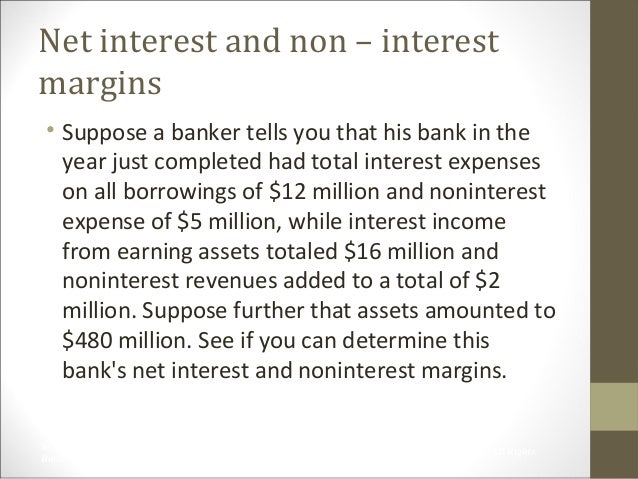

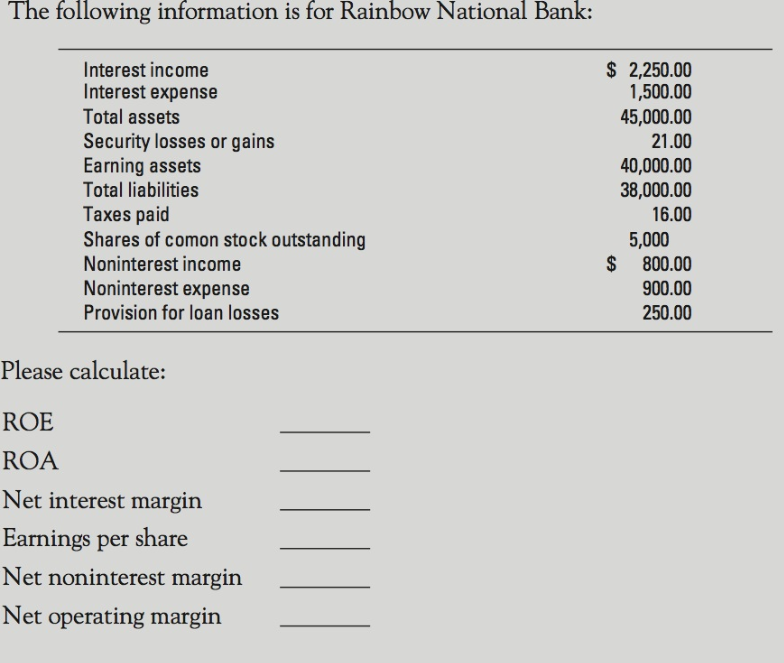

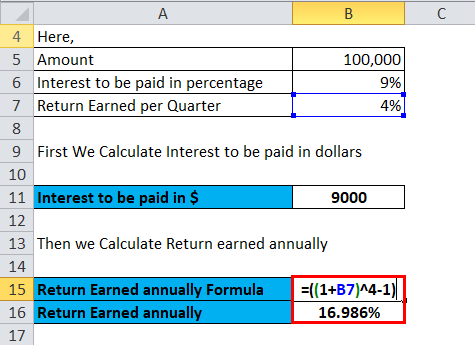

Net interest spread is expressed as interest yield on earning assets any asset such as a loan that generates interest income minus interest rates paid on borrowed funds.

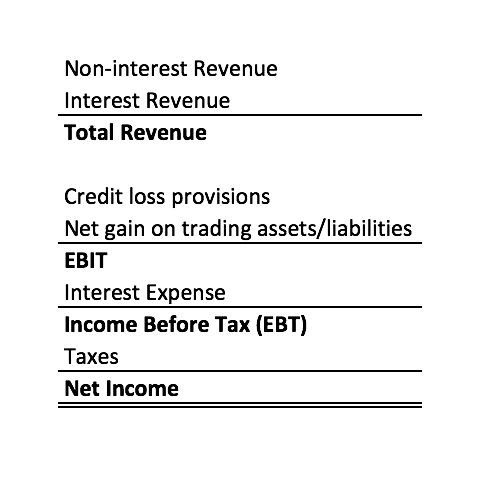

Net non interest margin. It is considered analogous to the gross margin of non financial companies. Funding composition of banks in australia. Berikut adalah rumus nim bank. It was showing that the bank was not generating enough noninterest income like revenues earned from loan services charges on deposit accounts trading accounts revenues income from investment etc to cover its total noninterest expenses like salaries wages and employee benefits this.

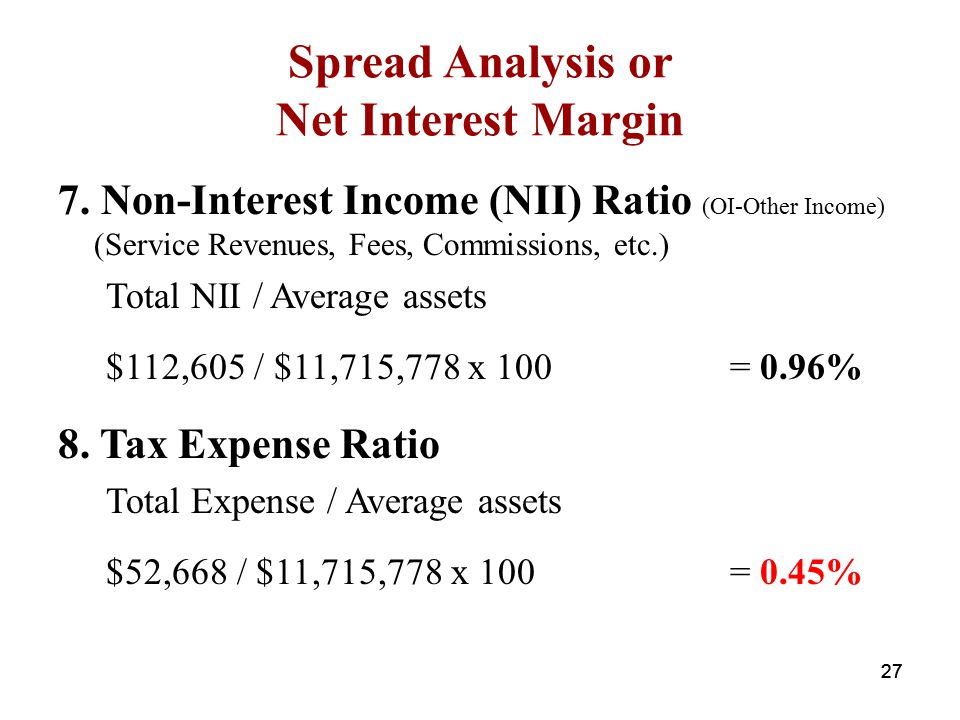

Non interest income is bank and creditor income derived primarily from fees including deposit and transaction fees insufficient funds fees monthly account service charges and so on. Net interest spread refers to the difference in borrowing and lending rates of financial institutions such as banks in nominal terms. Also referred as non interest margin it is the difference between non interest. The jamuna bank s net non interest margin showed a negative trend from 2009 to 2012.

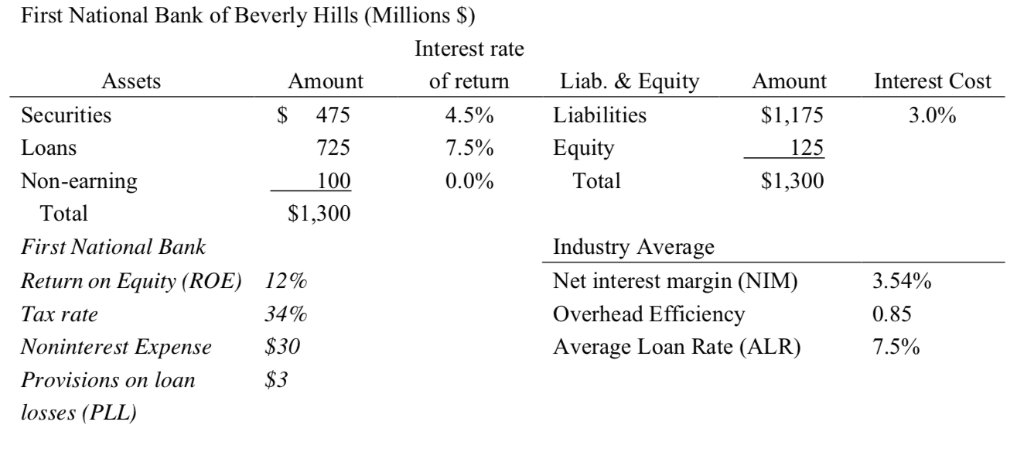

Banks non performing assets consolidated global operations. In other words this ratio calculates how much money an investment firm or bank is making on its investing operations. If such a bank marshaled together the deposits of five. This is a measurement of significance particularly for banks and credit card companies.

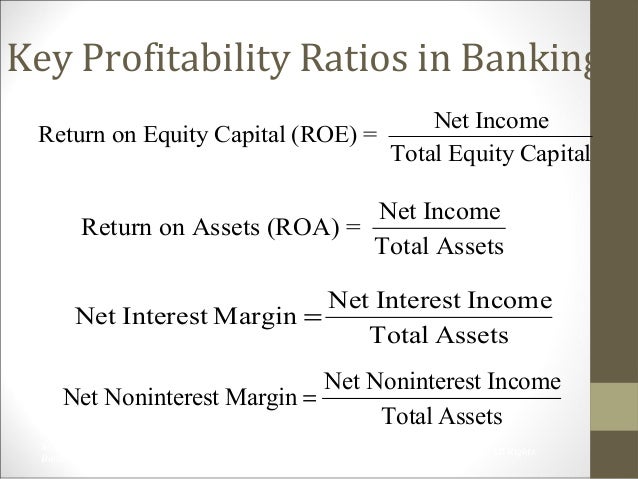

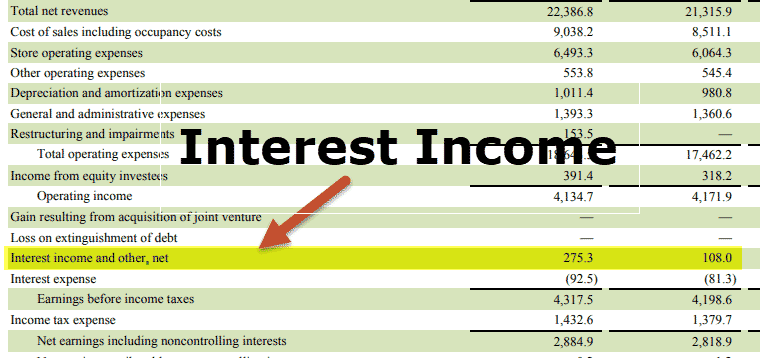

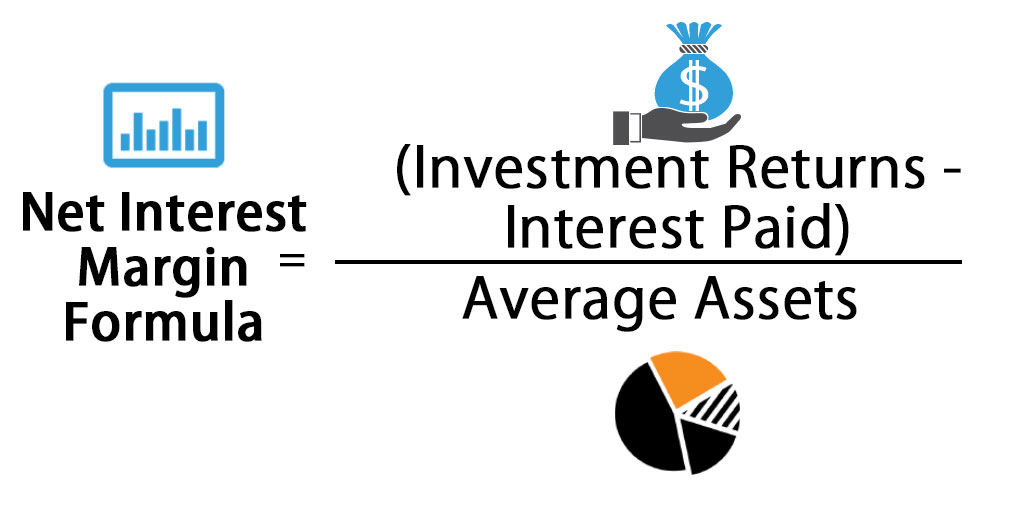

Net interest margin and retail banking. Most retail banks offer interest on customer deposits which generally hovers around 1 annually. Net interest margin nim is a measure of the difference between the interest income generated by banks or other financial institutions and the amount of interest paid out to their lenders for example deposits relative to the amount of their interest earning assets. No interest margin is a financial measurement that helps asses the usefulness of revenue from non interest items such as fees and service charges.

Download this single image. Major banks net interest margin. Banks non performing assets domestic books. Net interest margin nim is a profitability ratio that measures how well a company is making investment decisions by comparing the income expenses and debt of these investments.

Download this single image. Net interest margin is a popular profitability ratio used by banks which helps them determine the success of firms in investing in comparison to the expenses on the same investments and is calculated as investment income minus interest expenses this step is referred to as netting divided by the average earning assets. Yang dimaksud dengan pendapatan bunga bersih adalah pendapatan bunga setelah dikurangi dengan beban pokok. Download this single image.