How To Calculate Capital Allowance Malaysia

The amount of qe incurred will be used in the computation of initial allowance ia and annual allowance aa under schedule 3 of the ita.

How to calculate capital allowance malaysia. Rm rm year of assessment 2014 qe 200 000 ia 20 x rm200 000 40 000 aa 14 x rm200 000 28 000 68 000. Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances. More than 160 000 was identified for one client in. Examples of assets used in a business are motor vehicles machines office equipment furniture and computers.

Assuming that capital allowances are claimed over three years the capital allowances for ya 2020 for this asset will be 1 467 4 400 3 years. Capital allowance review service has acted for properties of all types from a chain of karaoke bars for which capital allowance savings of 412 791 were made to a property which a landlord rented out for which unclaimed capital allowances were identified to the tune of 22 of the property cost. Partial from a set of corporate income tax computation itc or either an individual with business income who going to claim for their capital allowance capital allowance schedulers analysis would be a large portion for most of the itc with tangible assets here i going to standardize and analysis the procedures steps by steps to be apply on your capital allowance ca schedulers. While annual allowance is a flat rate given every year based on the original cost of the asset.

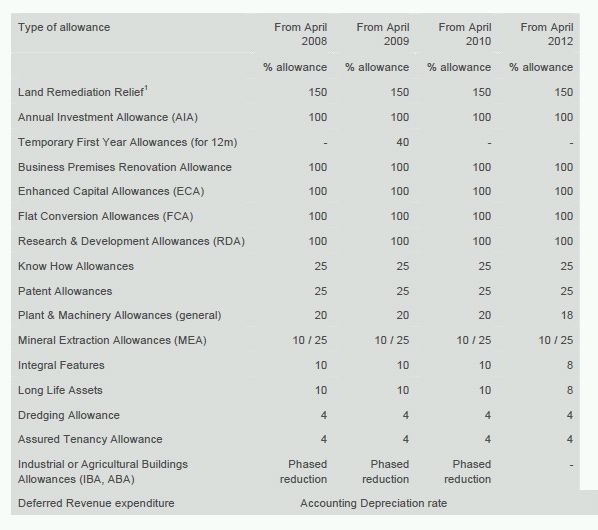

Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. Instead capital allowances calculated at the prescribed rates on a straight line basis are given in lieu of depreciation. The average on property improvements is 50. Computation of initial annual allowances in respect of plant machinery 1 0 tax law this ruling applies in respect of the computation of annual allowances for plant and machinery under paragraph 15 schedule 3 income tax act 1967 and the income tax qualifying plant annual allowances rules 2000 p u a 52 2000.

The value of the asset is increased from rm1 300 to rm2 000 and the total capital allowances capped is increased from rm13 000 to rm20 000 w e f. Capital allowances consist of an initial allowance and annual allowance. In total the capital allowance claim for ya 2020 will be 31 367 29 900. Business loss for the year of assessment 2016 capital allowances b f and current year capital allowances on other assets were rm160 000 rm30 000 and rm55 000 respectively.

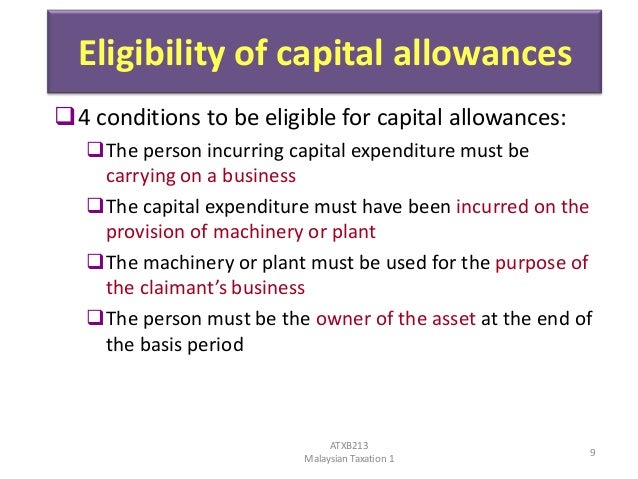

Conditions for claiming capital allowance are. Balancing charge allowance if the disposal value of a fixed asset exceeds the tax written down value the excess is known as a balancing charge the amount is restricted to the actual capital allowances claimed previously. This ruling is effective. Computation of capital allowances and balancing charge.

Company a can claim capital allowances on this 7 th piece of asset x over three years or over its useful life instead.