Director Remuneration And Director Fee

Provided that the approval of the shareholders under this provision shall be valid only till the expiry of the term of such director.

Director remuneration and director fee. Who approves the total amount of directors fees. The type of remuneration received will affect the need for disclosure of the remuneration the making of cpf contributions and also whether such payment will be subject to tax. The answer to who has the final right of approval of the total amount of directors fees depends on the type of company and possibly the company s constitution. Receive director s remuneration fees in the capacity as a non resident director of a company which is a tax resident in singapore.

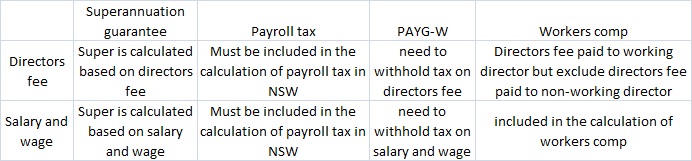

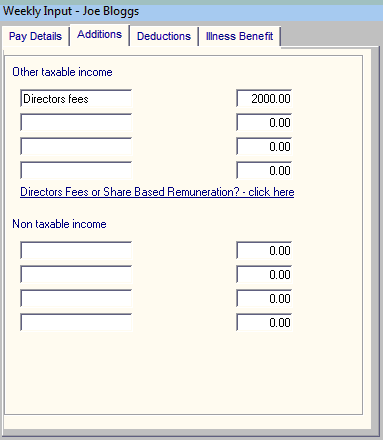

Remuneration can come in 2 forms namely director s fees and salary. If the non resident director received gains from stock options other share ownership plans esop esow refer to scenario 2. B the payment of the fixed fee for the sid is to be made on monthly basis of rm2 250 per month. We carefully watch the payment of salary and wage to working director before year end.

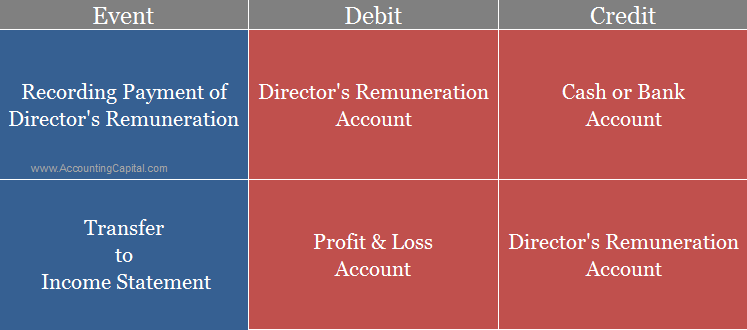

Generally a director can be remunerated in two ways director s fees and salary. On the other hand director s remuneration meaning the salaries and bonuses paid out to directors is part of the directors employment contract signed with the company. Fixed fee for senior independent director a any independent non executive director who is designated as a senior independent director sid is entitled to a fixed fee in addition to his her entitlement to the board fixed fee. As noted above director remuneration generally is dealt with under section 202 of the act.

It is not required for a company to pay its directors any director s fees but if it does this payment has to be approved in a general meeting by a. Director s fees approved in arrears the company voted and approved director s fee of 20 000 on 30 jun 2019 to be paid to you for your service rendered for the accounting year ended 31 dec 2018. In some cases company may include both director s salary and fee for the remuneration package. This is because director s fee is deemed as a payment for the contract for service and is not consider as an employee s remuneration.

Where there is more than one such director the aggregate annual remuneration to such directors exceeds 5 per cent of the net profits of the listed entity. Director s fees are fees to be paid to a director in their capacity as. Hence the earliest date on which the director is entitled to the director s fees is the date the fees are voted and approved at the company s agm. Typically the director s fee has to be approved during agm and can be payable in arrears or in advance.

Director s fees director s fees are paid to the director for directorial services rendered to the company.