What Is Conventional Banking

Thanks to experience and product selection traditional banks are more advanced.

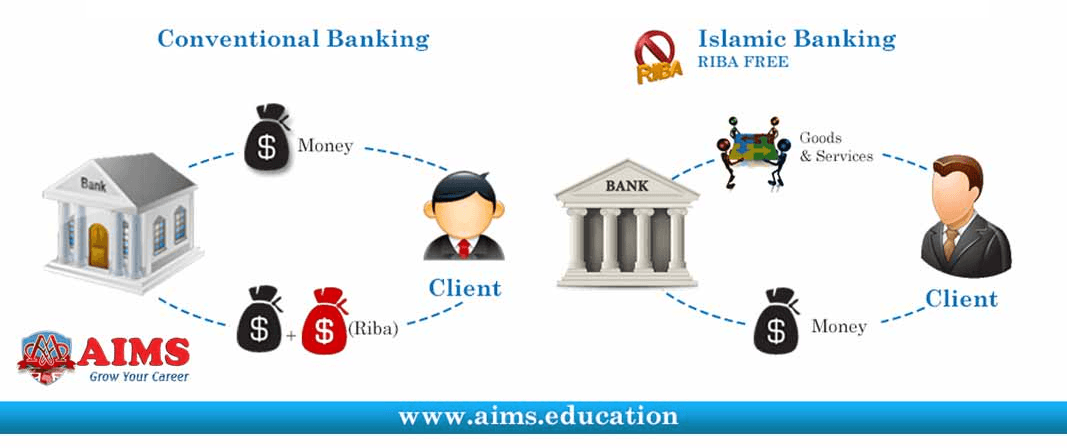

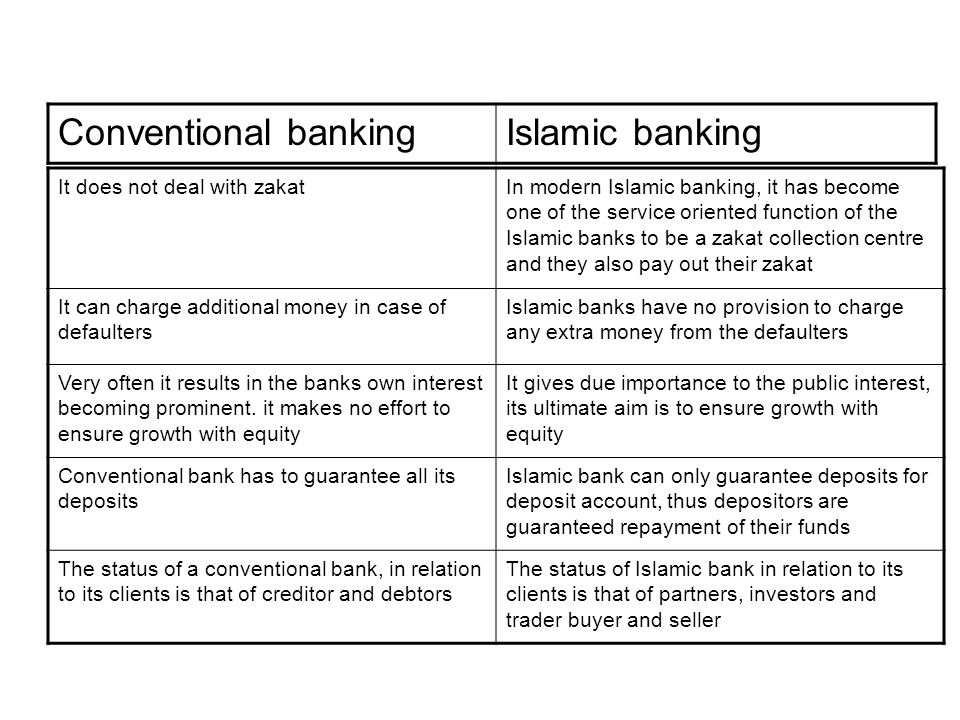

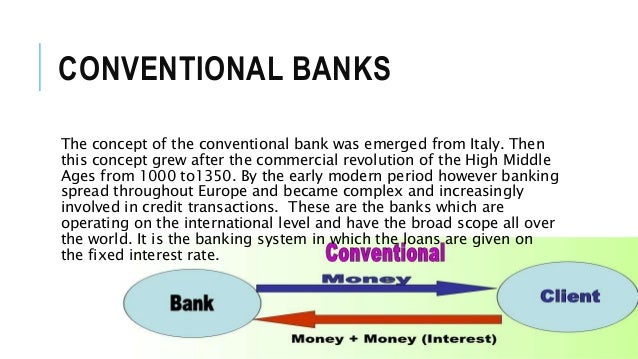

What is conventional banking. Commercial banks make money by providing and earning interest from loans such as mortgages auto loans business loans and personal loans. Islamic banking and conventional banking major differences. Conventional financing is one such scheme. Conventional banks offer lending facilities to their clients to fulfil their cash requirement on the basis of loan contracts where the relationship between the bank and client is that of lender and borrower respectively.

Conventional banking having a comprehensive banking solution is a must to be able to run a universal banking business with innovative and the best in class technologies. Conventional banking loan contracts characteristics. Conventional financing is a home financing scheme offered by financial institutions or banks. Electronic banking is doing all of your banking needs online or on your phone.

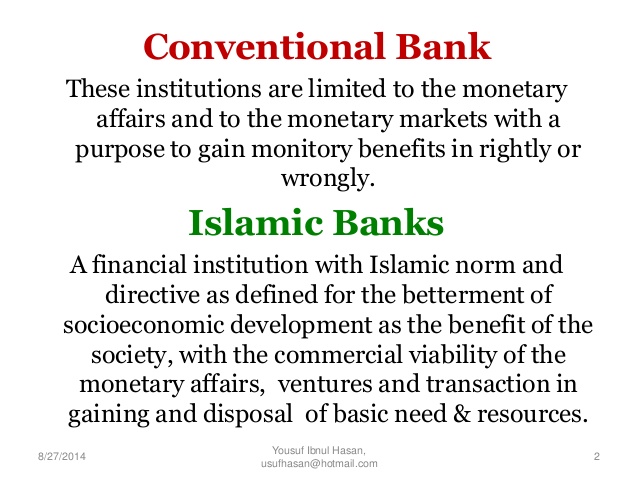

Electronic banking is doing all of your banking needs online or on your phone. Payment flexibility is a crucial factor in offering a seamless checkout experience. On the other hand conventional banking is an un ethical banking system based on man made laws. Conventional banking is a person walking into a bank and talking to another person.

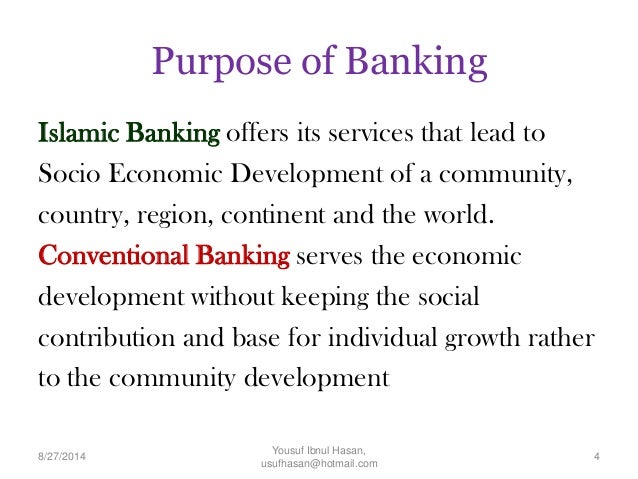

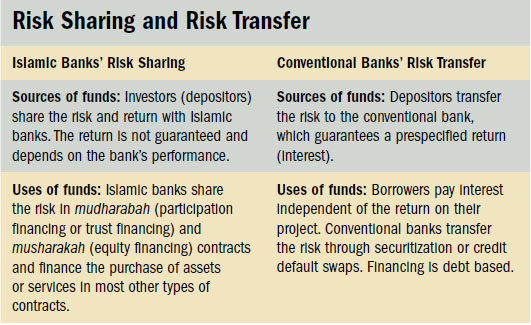

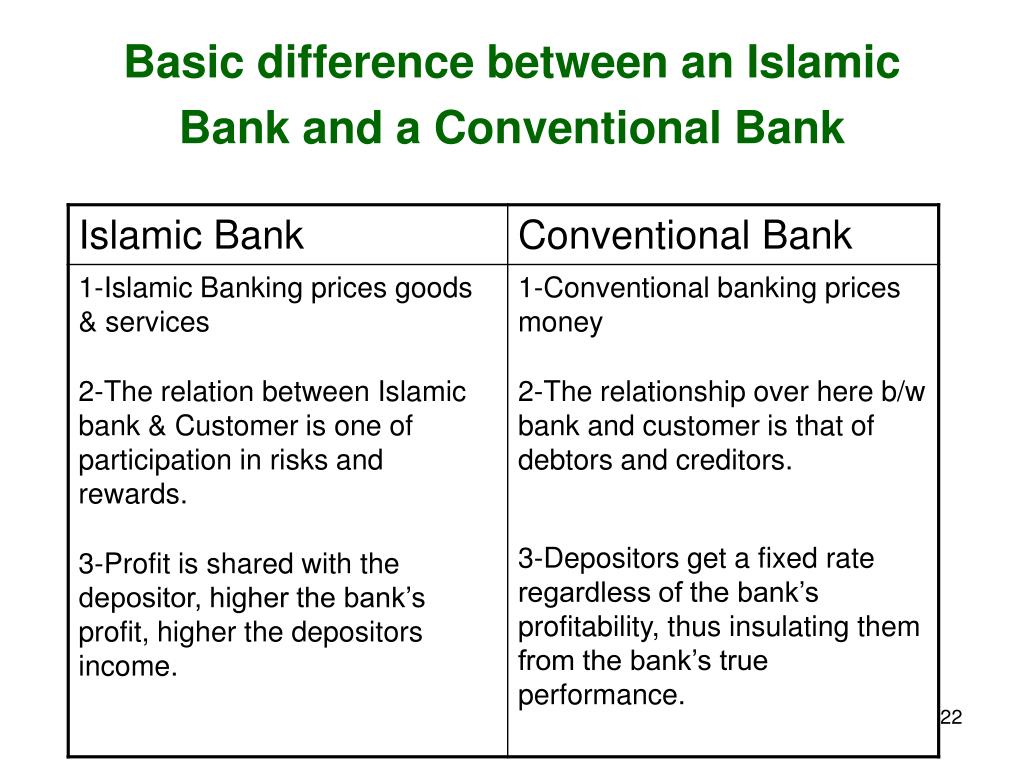

Income through interest 3. The conventional bank is based on a full fledged intermediary model that lends borrowers to suppliers and then loans to companies or individuals. Conventional banking is a person walking into a bank and talking to another person. Now let us review some major differences between islamic banking and conventional banking systems.

A commercial bank is where most people do their banking. An islamic window refers to services that are based on islamic principles that are provided by a conventional bank. Whether it be using a bank transfer a credit card a mobile wallet or even cash. On the other hand conventional banking systems are much longer than islamic banks.

No risk of underlying assets 2. It is profit oriented and its purpose is to make money through interest. In the first quarter of 2018 conventional loans were used for 74 of all new home sales making them the most popular home financing option by a long shot.