Tax System In Malaysia

All income accrued in derived from or remitted to malaysia is liable to tax.

Tax system in malaysia. Malaysia s progressive personal income tax system involves the tax rate increasing as an individual s income increases starting at 0 for up to rm5 000 earned to a maximum of 28 for annual income of over. This article describes the tax filling system in malaysia. Malaysian tax what is tax clearance in malaysia tax clearance is nothing but a letter or certificate issued by the malaysian inland revenue lhdn lembaga hasil dalam negeri malaysia which says that if have any dues with the income tax department of malaysia. This letter is issued for local people as well as expatriates in malaysia.

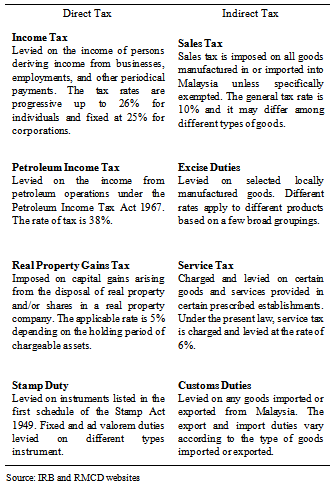

The income tax with the highest rate only recently being at 28 has been cut down now to 26 for residents and 27 for non residents. Malaysia was relying on a workable taxing system for decades and this has been helping the economy without relying on gst for many people there is no need to change an. 03 21731288 this publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practice. Malaysia adopts the self assessment system where the taxpayer is responsible for computing one s own chargeable income and tax payable as well as making payments of any balance of tax due.

Calculations rm rate tax rm 0 5 000. In addition taxes like estate duties annual wealth taxes accumulated earnings tax or federal taxes are not levied in malaysia. Malaysia s taxes are assessed on a current year basis and are under the self assessment system for all taxpayers. Moreover it describes the entire procedure of e filling registration penalties for not paying tax and may more.

Green technology educational services healthcare services creative industries financial advisory and consulting services logistics services tourism. Box 10192 50706 kuala lumpur malaysia tel. If you are working in malaysia for more than 182 days a year the government considers you to be a tax resident and you will pay progressive tax rates and be eligible for tax deductions. The online tax file registration makes the registration process much easier.

The amount of tax payable for the year must be self computed and the tax return is deemed to be a notice of assessment upon its submission. However if you face any complication s f consulting firm is always there for you. Tax clearance letter will also indicate if you have. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.

It is not even good for business because collection of such taxes are difficult businesses often decline and before it can be claimed it requires rm500k as volume of sales made before the tax can be claimed.