Private Retirement Scheme Public Bank

This pension is applicable for employees that take up voluntary retirement from bank.

Private retirement scheme public bank. Private retirement schemes prs is a voluntary long term savings and investment scheme designed to help you save more for your retirement. The contents in this website were prepared in good faith and the private pension administrator malaysia ppa expressly disclaims and accepts no liability whatsoever as to the accuracy relevance completeness or correctness of the information and opinion. Will you have enough to retire. If you ve been thinking of contributing here s what you need to know about prs.

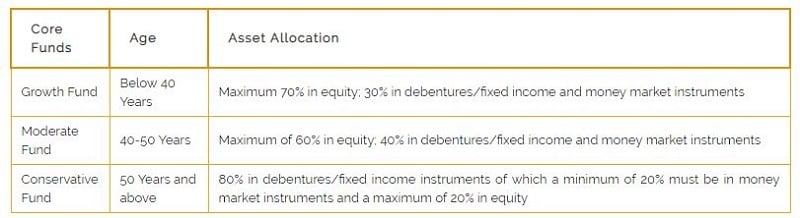

Everyone deserves to look forward to a happy and financially secured retirement after many years of working. Structured product investment. 4 the age group may be subject to changes as may be determined by the relevant authorities. 3 these are funds under the default option that meet the investment limits specified in guidelines on private retirement scheme issued by the securities commission malaysia sc.

To combat the lack of retirement savings the private retirement scheme prs was introduced in 2012 and sought to encourage people to build their retirement income in another way beyond epf. Job security is always present in a public sector bank but private sector bank job is secure only when the performance is good because performance is everything in a private sector. Please refer to the disclosure document and the relevant fund s product highlights sheet for more details of the prs funds. Prs is offered by unit trust companies whereas deferred annuity is offered by insurance companies.

Along with job security one more pro of a public sector bank is the after retirement benefit i e. Unit trust private retirement scheme. Public bank a complete one stop financial portal offering a range of accounts credit cards loans. Public bank a complete one stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers.

The minimum service period required to qualify for vrs pension scheme is. Pension on voluntary retirement. Prs seek to enhance choices available for all malaysians whether employed or self employed to supplement their retirement savings under a well structured and regulated environment. Unit trust private retirement scheme.

To be financially secured at retirement you will need to save adequately in order to provide 2 3 of your last drawn salary to continue the same lifestyle you have become accustomed to.