Net Non Interest Margin Formula

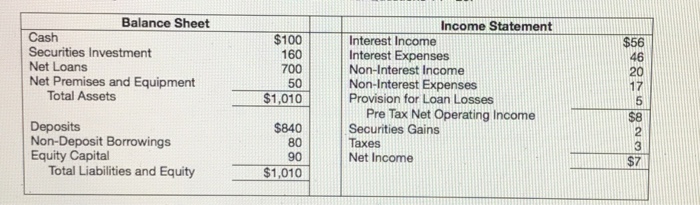

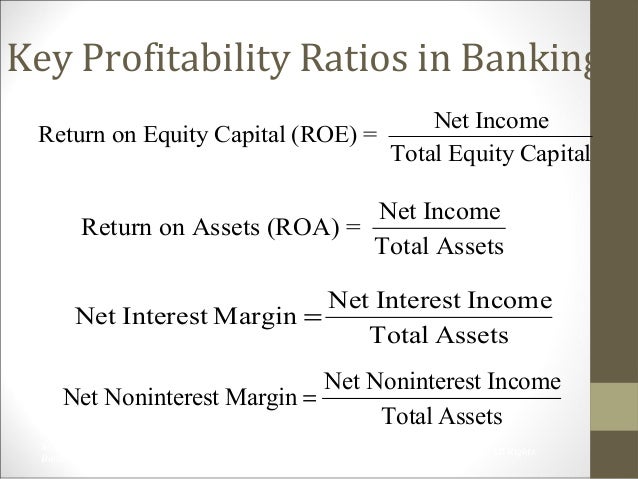

Yang dimaksud dengan pendapatan bunga bersih adalah pendapatan bunga setelah dikurangi dengan beban pokok.

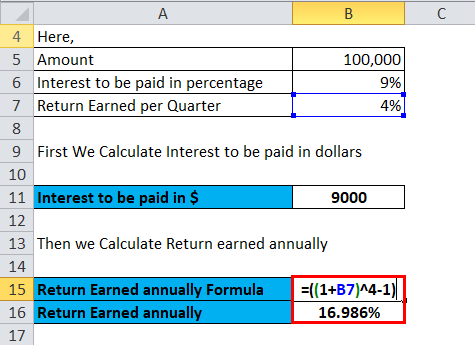

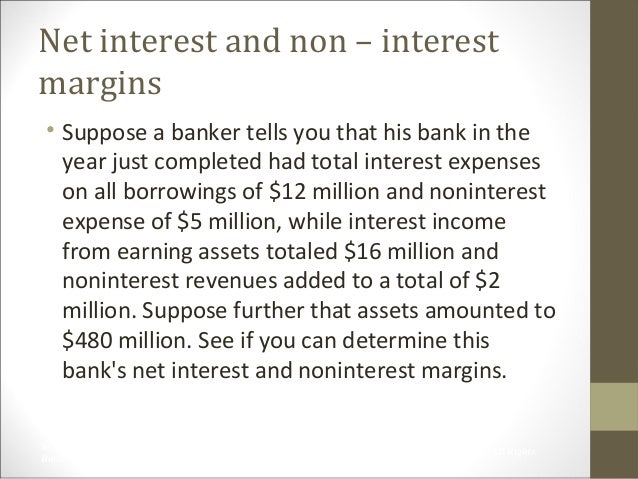

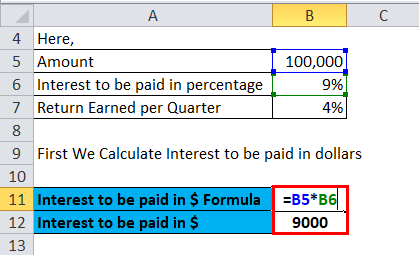

Net non interest margin formula. The company itself might have some investments and must be earning interest on those investments. The net interest spread formula is used to determine the difference between the rate a bank is earning versus the rate a bank is incurring. Calculation of the formula. Risk is an important consideration and individuals often want a risk premium for any extra risk.

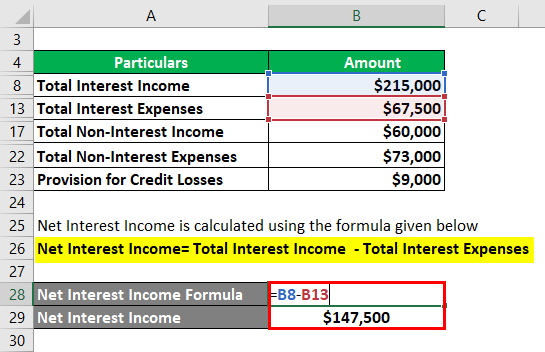

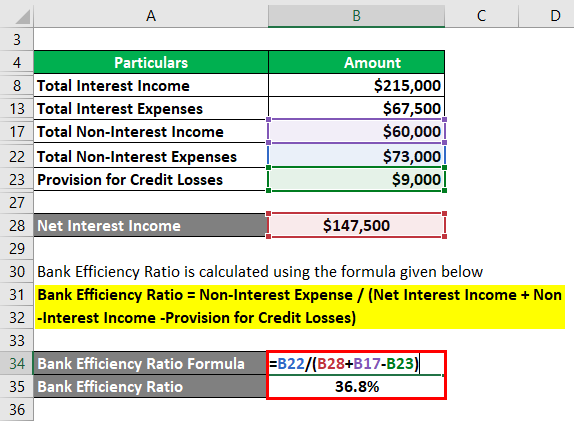

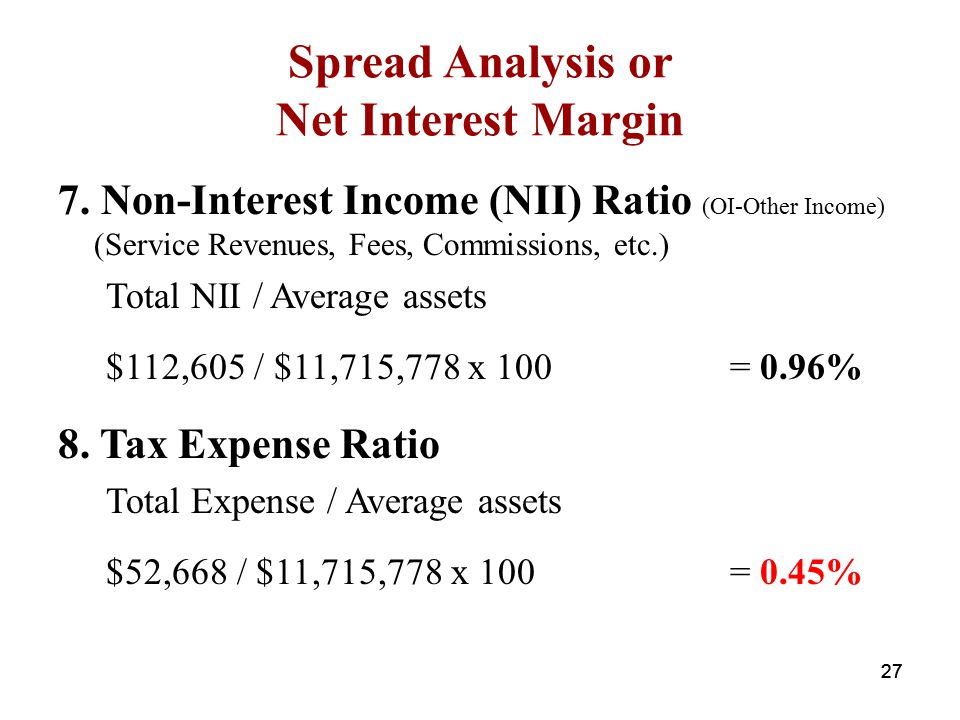

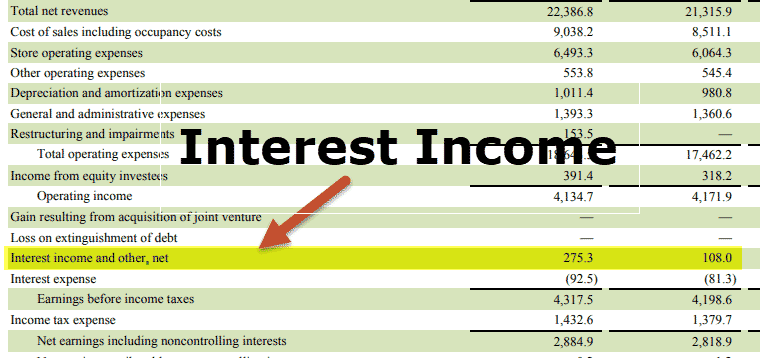

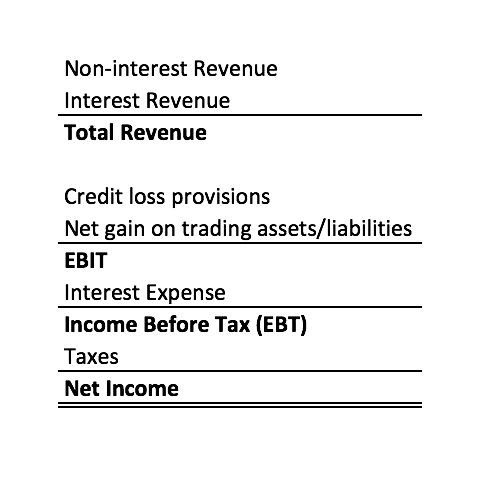

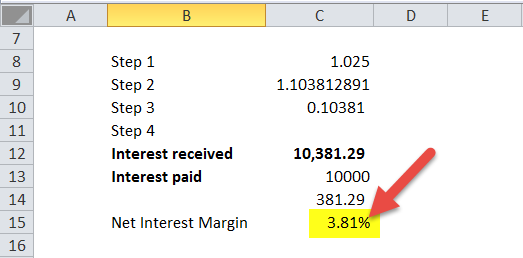

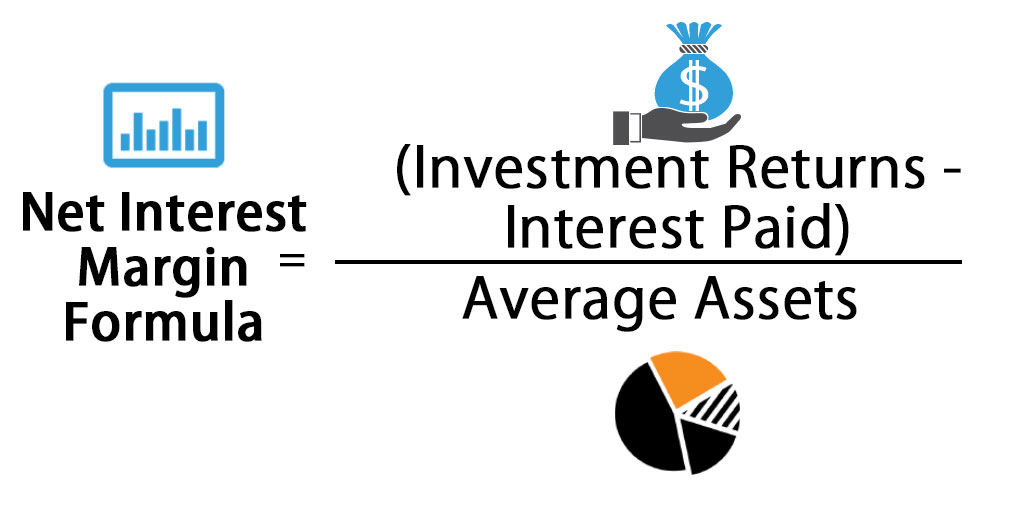

No interest margin non interest income non interest expense total earning assets. Net interest margin is a metric that examines how successful a firm s investment decisions are compared to its debt. The first step in calculating the net interest margin equation is to sum up the investment returns also known as interest income. Net interest margin investment income interest expenses average earning assets.

The rate or yield that a bank earns and the rate or yield that a bank pays is often found in the bank s 10k statement typically in sections that breakdown the interest income and interest expense portion of the income statement. To illustrate this issue assume the very unlikely fictional situation where one bank has a 3 margin while another bank also has a 3 margin. Net interest margin is a popular profitability ratio used by banks which helps them determine the success of firms in investing in comparison to the expenses on the same investments and is calculated as investment income minus interest expenses this step is referred to as netting divided by the average earning assets. The net interest margin formula does not look at risk.

It is similar to the gross margin or gross profit margin of non financial companies. Using the aforementioned formula the bank s net interest margin is 2 92. Rasio net interest margin nim adalah rasio yang digunakan untuk menganalisis seberapa besar pendapatan bunga bersih dibandingkan dengan aset produktif perusahaan. Berikut adalah rumus nim bank.