Net Non Interest Margin Formula For Banks

However the net interest margin formula does not offer much in isolation.

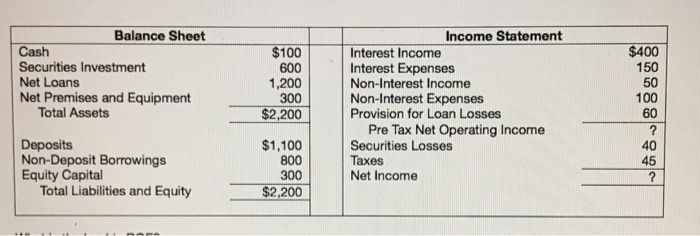

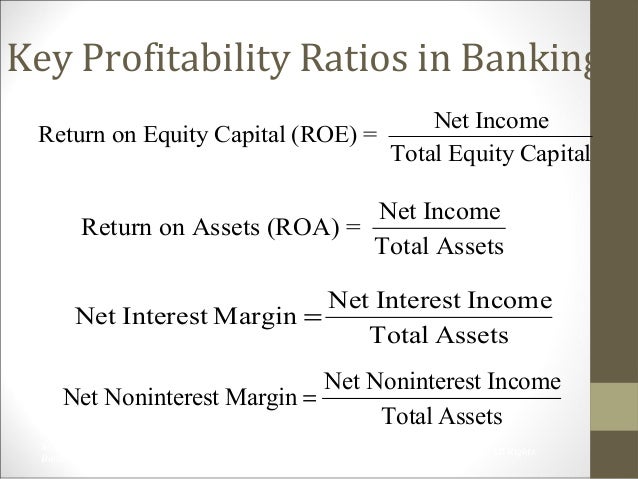

Net non interest margin formula for banks. Rasio net interest margin nim adalah rasio yang digunakan untuk menganalisis seberapa besar pendapatan bunga bersih dibandingkan dengan aset produktif perusahaan. It can also be used by investors looking to invest in a bank. Most retail banks offer interest on customer deposits which generally hovers around 1 annually. In other words this ratio calculates how much money an investment firm or bank is making on its investing operations.

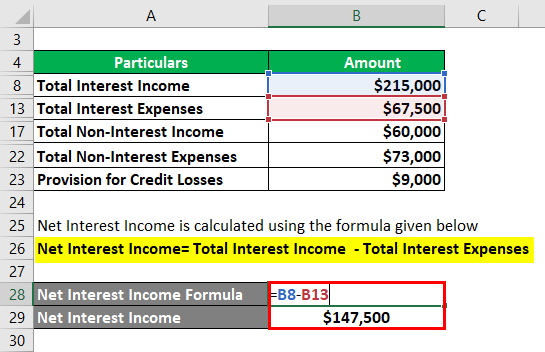

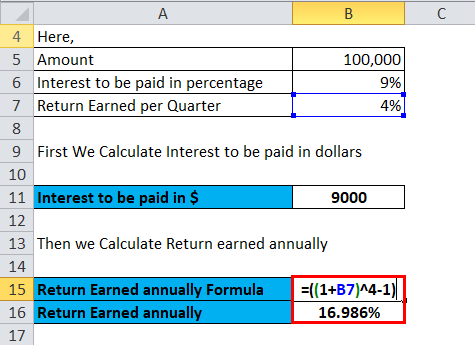

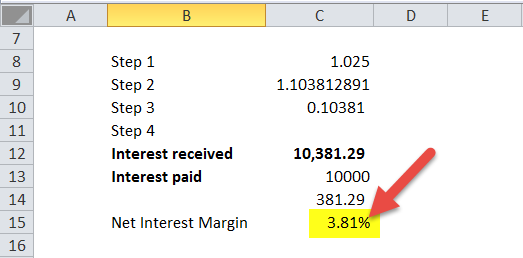

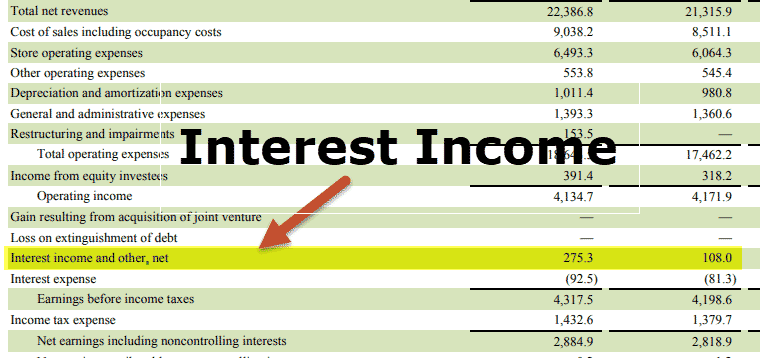

Yang dimaksud dengan pendapatan bunga bersih adalah pendapatan bunga setelah dikurangi dengan beban pokok. Interest income interest expenses and average earning assets can be used to determine a bank s net interest margin which shows whether a bank is making wise investments. The net interest margin formula can be used internally by banks to gauge its profitability. But the long term trend has been more or less.

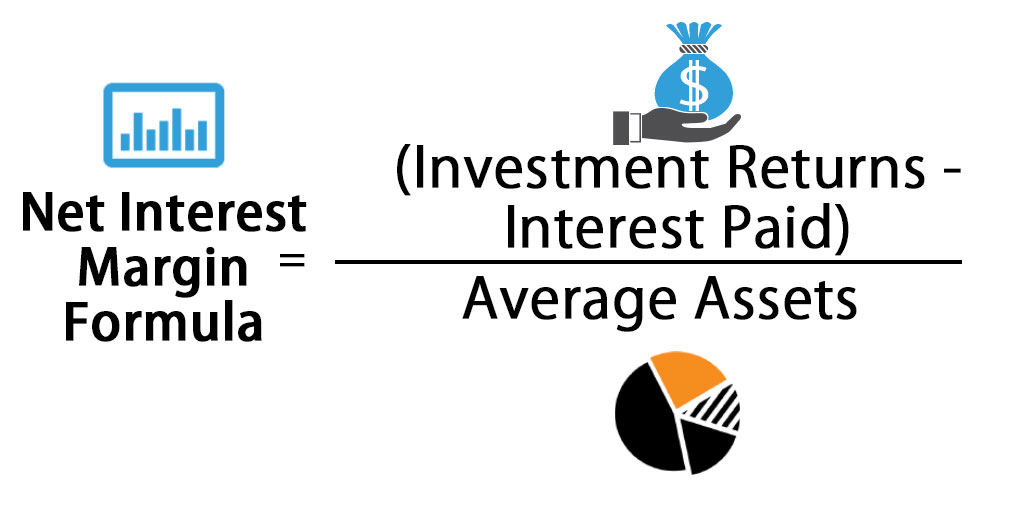

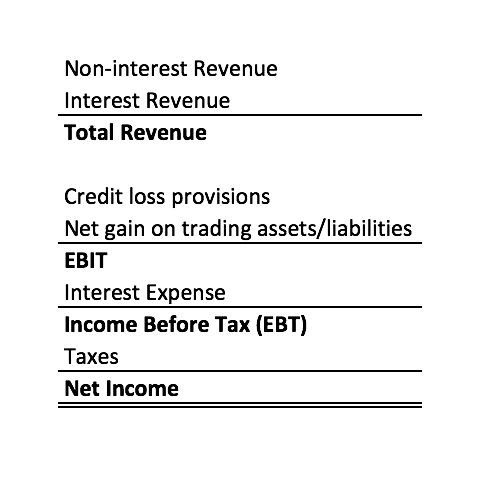

Use of net interest margin. As stated earlier banks have additional non interest income and incur operating expenses. Berikut adalah rumus nim bank. Net interest margin nim is a measure of the difference between the interest income generated by banks or other financial institutions and the amount of interest paid out to their lenders for example deposits relative to the amount of their interest earning assets.

That figure shows a slight rebound from a 30 year low of 2 98 in 2015. The average net interest margin nim for american banks was 3 3 in 2018. It is similar to the gross margin or gross profit margin of non financial companies. Net interest margin formula once you obtain the interest income interest expenses and average earning assets from the bank s income statement you are ready to calculate the net interest margin.

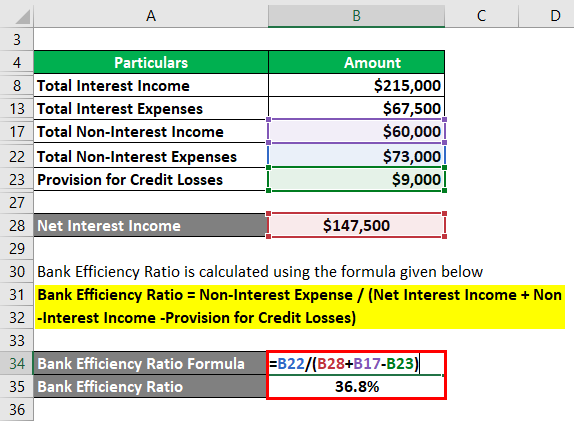

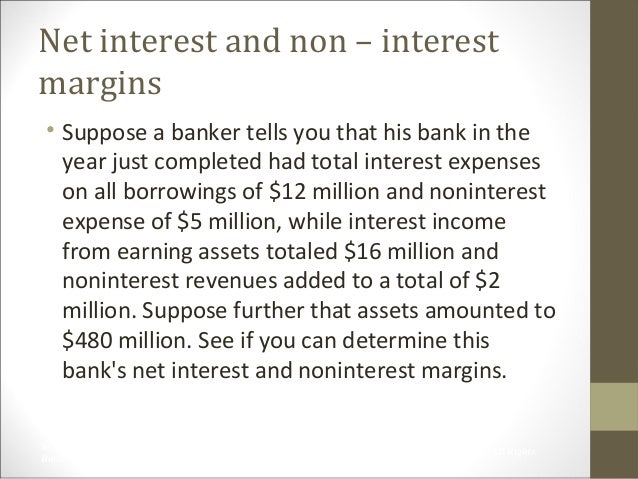

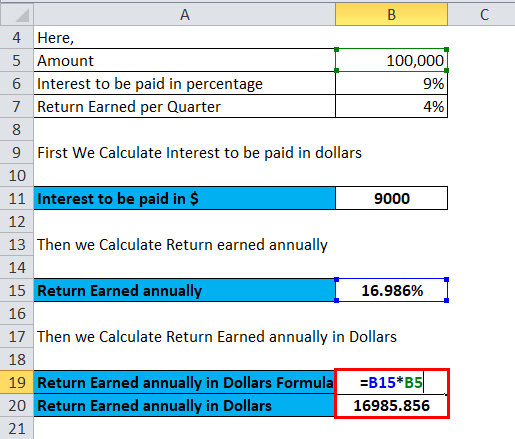

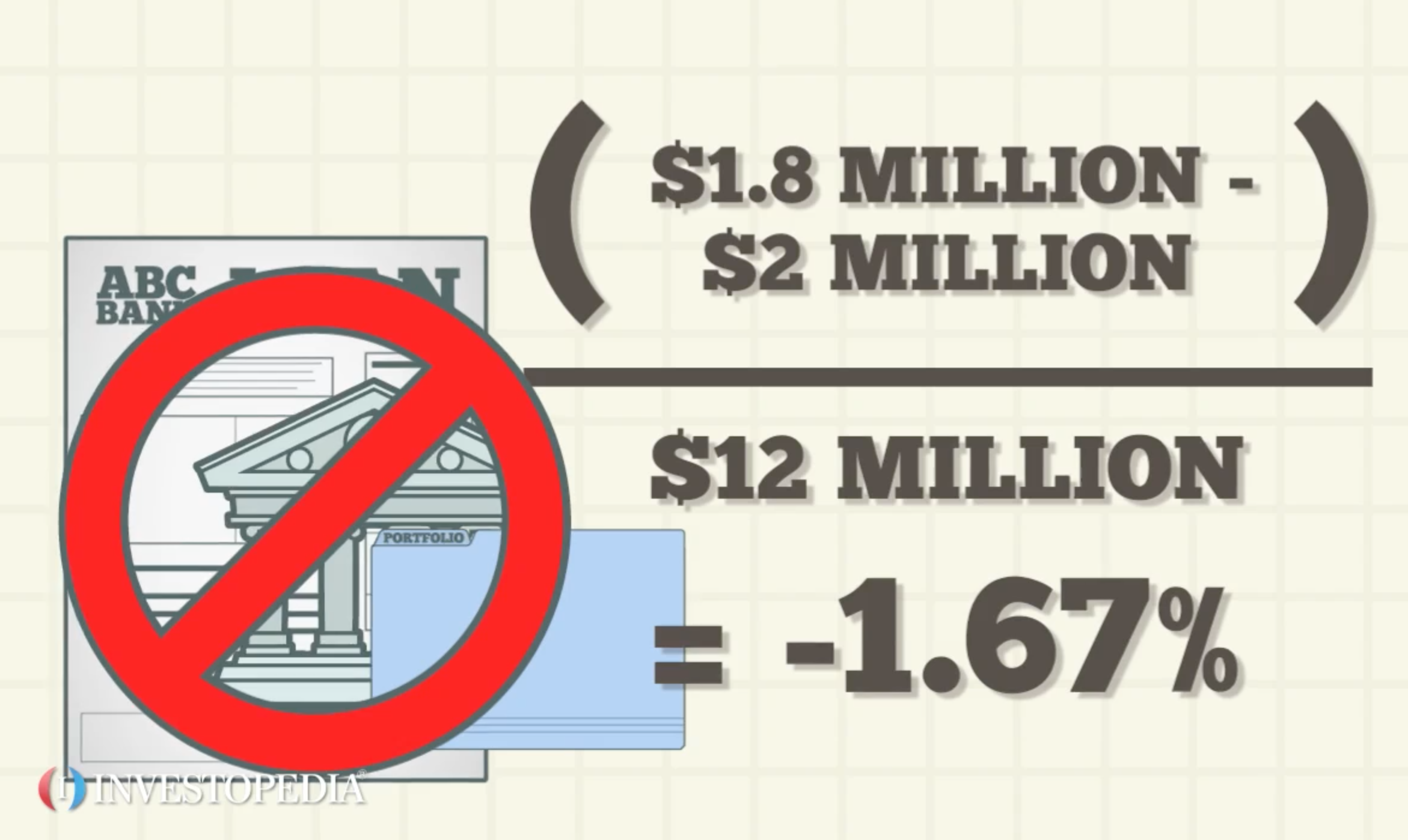

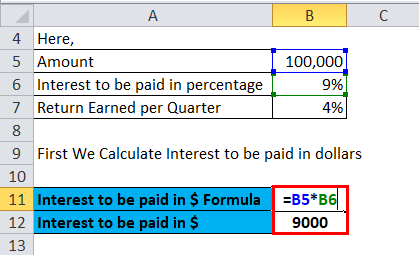

The purpose of this paper is to investigate the interrelationship between non interest income nii and net interest margin nim in the vietnamese banking system between 2006 and 2015. Net interest margin and retail banking. No interest margin non interest income non interest expense total earning assets. For instance if a financial firm earns 500 000 in a month from fees and service charges registers fixed operating costs of 400 000 and total earnings on assets are 100 000.

Net interest margin nim is a profitability ratio that measures how well a company is making investment decisions by comparing the income expenses and debt of these investments.