Musharakah Mutanaqisah Home Financing

Some practical issues 125 where pv present value of the monthly or periodic installments which is the loan amount itself.

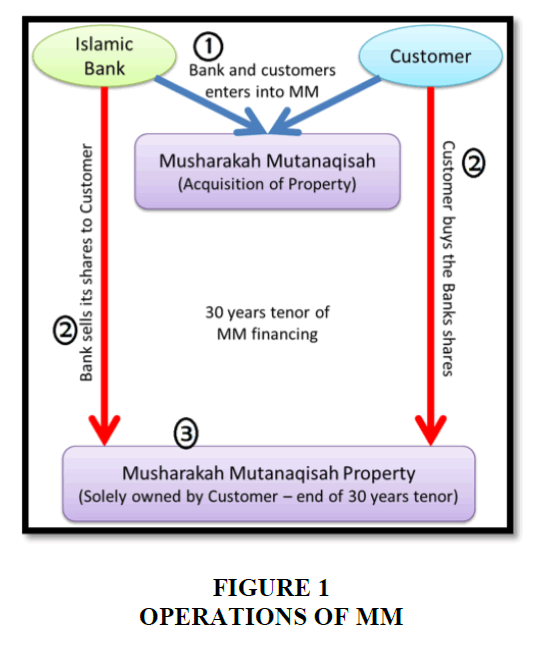

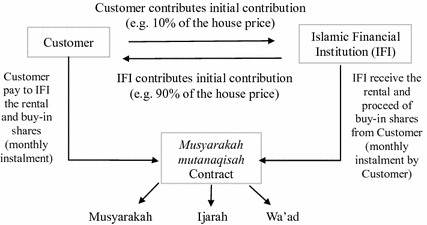

Musharakah mutanaqisah home financing. Musharakah mutanaqisah the bank and the customer agree to jointly purchase and co own a property which is called a musharakah agreement. What are the advantages. Musharakah mutanaqisah in the malaysian context is not an equity partnership arrangement although some banks would like to think so. Mmp consists of three contracts which are musharakah ijarah as well as bay first the customer enters into a musharakah under the.

Musharakah mutanaqisah is an islamic equity financing instrument. Azlinda binti harun2011149521hajar binti ahmedy2011157475musyarakah mutanaqisah as analternative to bba inhome financing 3. Pmt the monthly or periodic installments principal and interest. Musharakah mutanaqisah mm home financing for affordability of homeownership.

Both customer and the bank will contribute to the musharakah by contributing musharakah shares the customer will contribute by paying the deposit while the bank will contribute the remaining finance amount. Musharakah mutanaqisah is an alternative contract that can be offered under home financing and can replace bai bithaman ajil bba as bba is similar to fixed rate debt financing or murabahah. A musharaka structure where the equity is concerned carries valuation risks where the equity is not principally guaranteed. Essentially islamic banks follow two types of islamic banking principles bai bithaman ajil bba and musharakah mutanaqisah mm.

For more information on the difference between islamic and conventional financing see types of home loans in malaysia. Musharakah mutanaqisah partnership mmp mmp based on diminishing partnership concept. A simulation case study approach since 1990s the increase in housing price housing loan application rejection and bankruptcy due to housing loan default have highlighted the need for a better way of home financing. I the monthly or periodic interest rate.

This paper aims to examine the practical issues in the musharakah mutanaqisah mm financing and subsequently recommends possible solutions to mitigate these issues and improve the current practice this paper analyses the theory and current practices of mm offered by islamic banks it is suggested that islamic financial institutions consider revaluation of property s value to its fair. The following is the conclusion of the paper. Musharakah is a joint enterprise or partnership structure in islamic finance in which partners share in the profits and losses of an enterprise. In a musharaka if there is a valuation loss the bank and the customers share the.