Islamic Banking Products In Malaysia

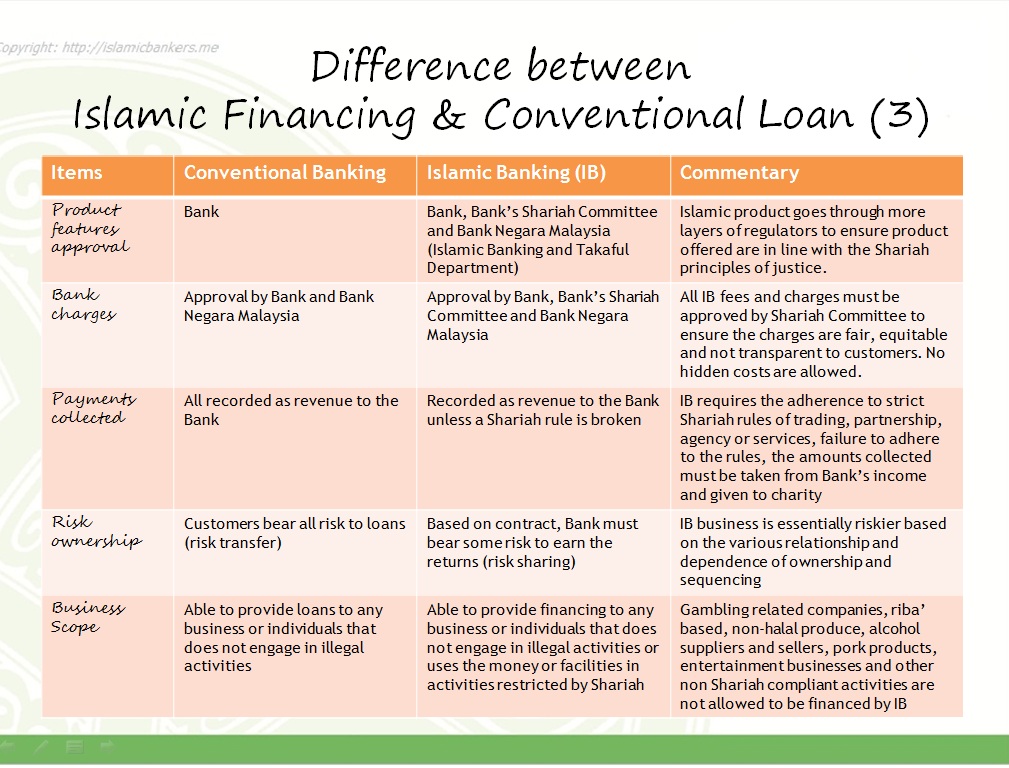

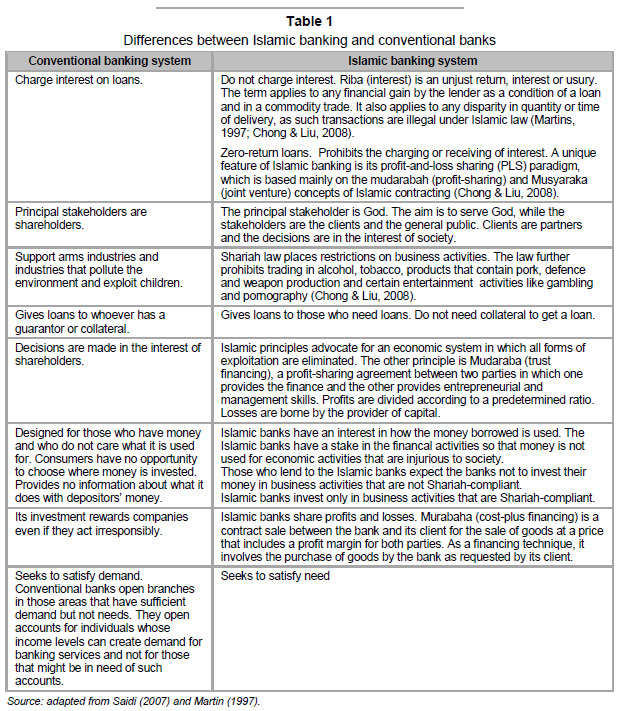

However some distinct differences can be observed.

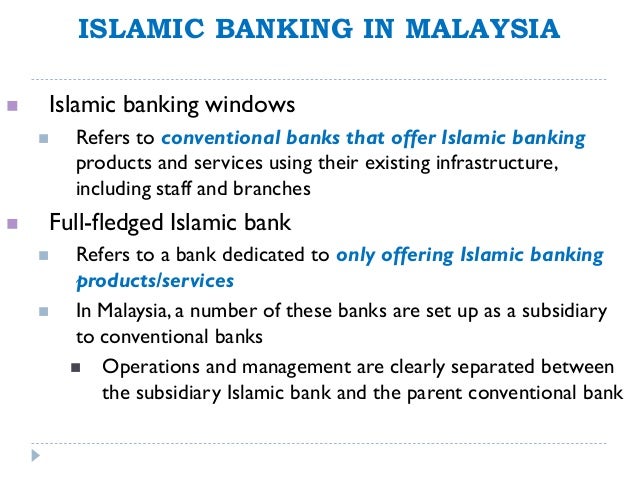

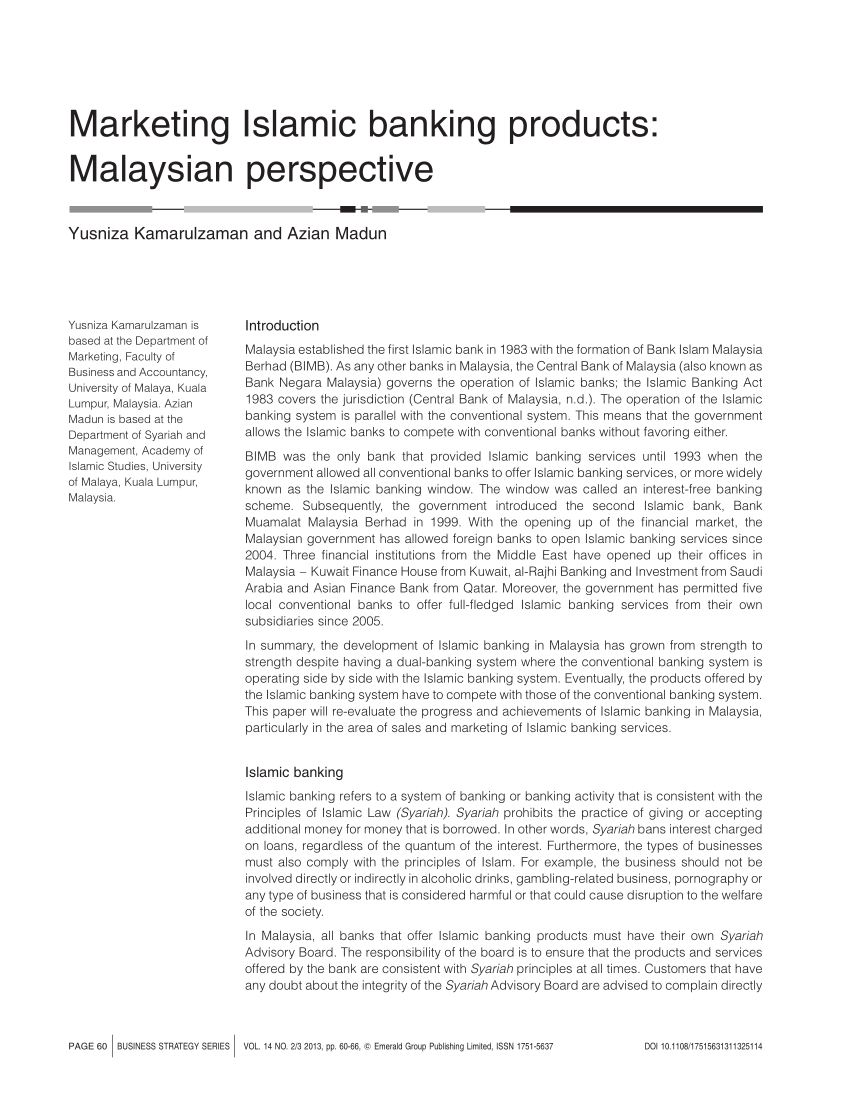

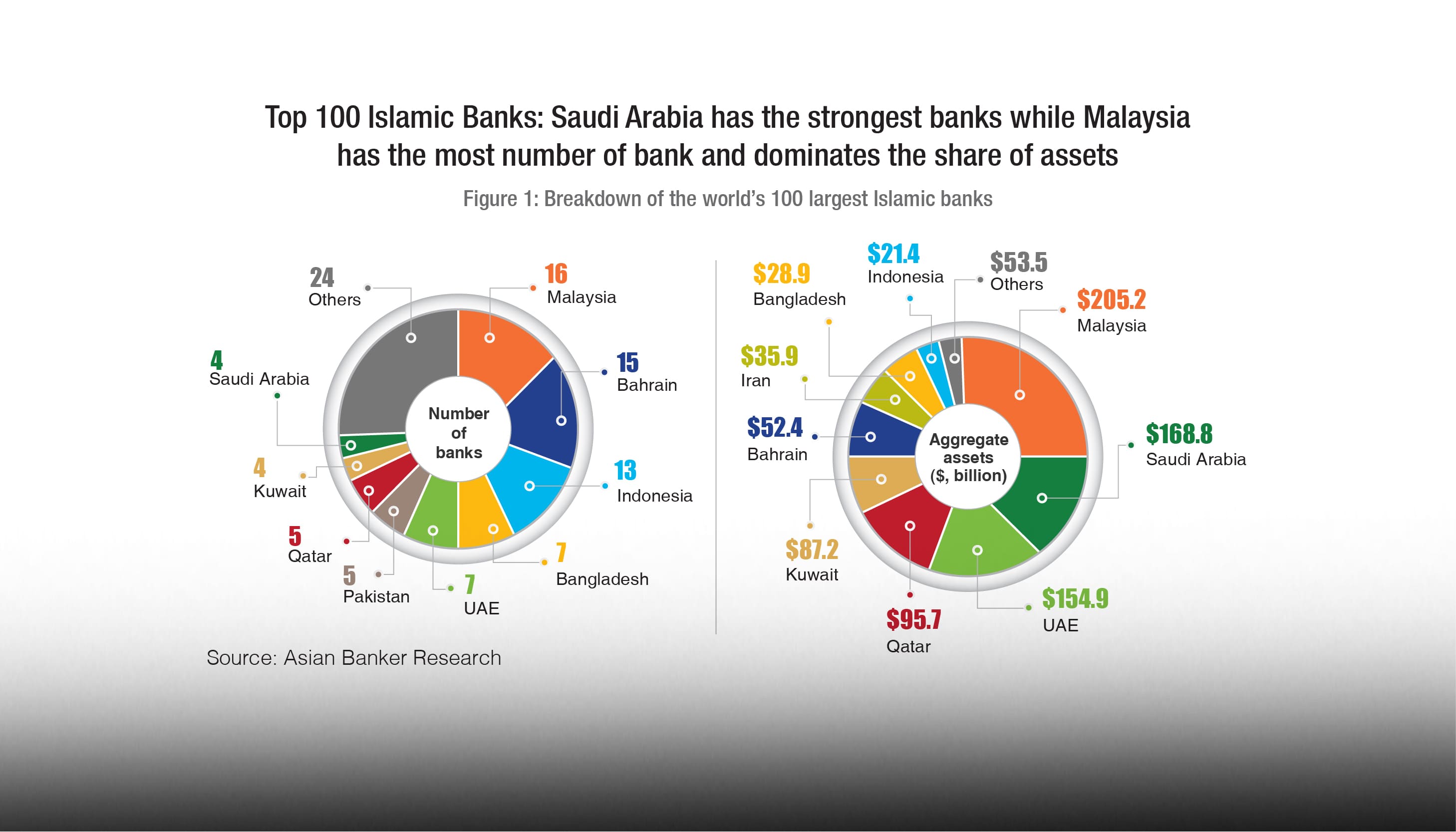

Islamic banking products in malaysia. To browse through islamic banking and financial products click here. Ambank islamic s comprehensive range of shariah compliant retail and non retail banking products and services including investment treasury and trade solutions and delivery channels. In 1993 commercial banks merchant banks and finance companies were allowed to offer islamic banking products and services under the islamic banking scheme ibs. The underlying principles that govern islamic banking are mutual risk and profit sharing between parties the assurance of fairness for all and that transactions are based on an underlying business activity or asset.

Continuously evolve in line with market changes. At prevailing bank negara malaysia s islamic interbank money market iimm rate on the total outstanding balance of facility calculated on daily rest basis. Islamic banking takaful. Malaysia s central bank bank negara malaysia has rolled out a plan to standardise shariah contracts over the next two years.

Any individual who is 18 years old and above can buy islamic banking products and services. It refers to the sale of goods at a price which includes a profit margin cost plus. This dynamic approach supports the agenda to help individuals businesses and institutions in malaysia grow and win together. Mohammed waseem april 7 2014 islamic banking products part 3 murabahah 2014 04 07t14 53 42 00 00 islamic banking products 2 comments by mohammed waseem murabahah is another product based on the islamic sharee ah.

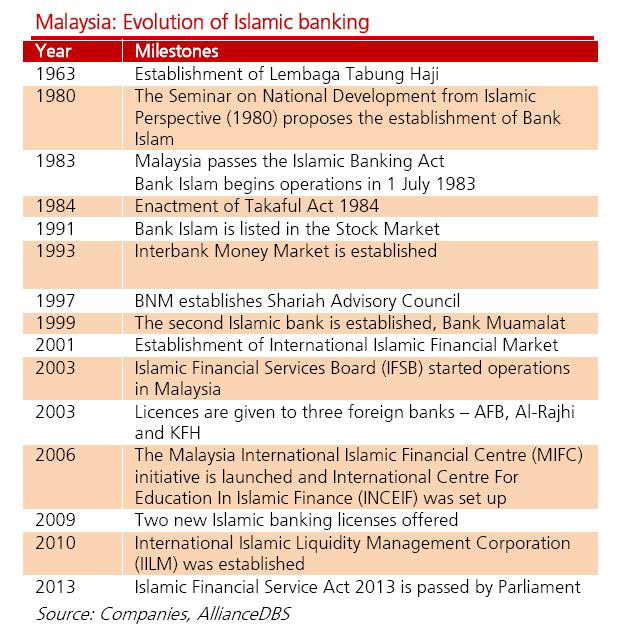

Continuously evolve in line with market changes. The first islamic bank in malaysia was established in 1983. Will islamic banking products and services be offered across all uob branches. As the islamic banking system developed services offered by islamic banks and banking institutions under islamic banking scheme have become diversified table 1.

Citibank provides islamic banking and financial services in malaysia with wide range of products. In fact surplus sharing means they may be even be more so. Islamic banking refers to a system of banking that complies with islamic law also known as shariah law. Islamic banking services are very similar to those in conventional banks.