How To Calculate Balancing Charge Lhdn

Mary a driving instructor bought a car for her business six years ago for 11 500.

How to calculate balancing charge lhdn. 4 4 balancing allowance refers to the difference where the disposal value of an asset is less than the residual expenditure. With effect from the year 2015 an individual who earns an annual employment income of rm34 000 after epf deduction has to register a tax file. To calculate the balancing charge add the amount you sold the item for to the capital allowances you claimed then subtract the amount you originally bought the item for. Is it just the monthly salary you get from your employer or does it also include other types of income.

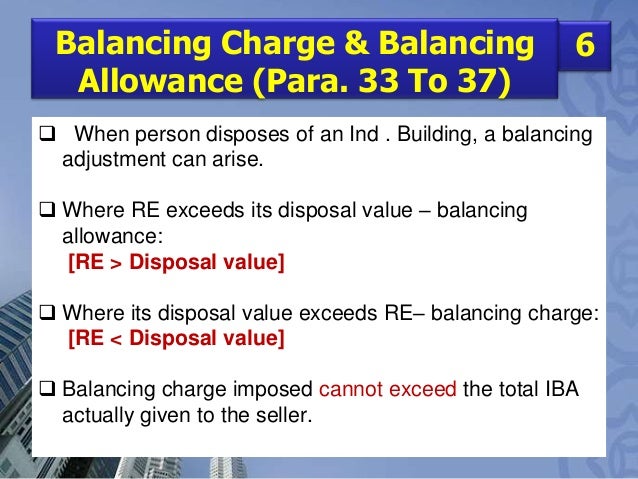

First of all you need to know what is considered income by lembaga hasil dalam negeri lhdn. 4 5 balancing charge refers to the difference where the disposal value of an asset is more than the residual expenditure. The annual allowance is given for each year until the capital expenditure has been fully written off unless the fixed asset is sold scrapped or disposed in which case a balancing allowance or balancing charge will be calculated. 3 7 balancing charge is the excess that arises where the sale price of a plant machinery or industrial building which is purchased constructed and used in for the purposes of the business exceeds the residual expenditure of that asset.

4 6 plant for the purpose of qualifiying expenditure means any movable or. However the amount of the balancing charge should not exceed the total capital allowances allowed. Balancing allowance 18 000 103 000 statutory income chargeable income 17 000 7 2 balancing charge balancing charge arises when the disposal value of a plant or machinery exceeds the residual expenditure. This guidelines is effective from ya2013 in line with the changes in certain provisions of schedule 3 of ita 1967 announced during budget 2013.

When a fixed asset is sold or written off you need to calculate balancing allowance ba or balancing charge bc if capital allowance has been claimed for the asset previously. Example of a balancing charge. The balancing charge will be added back to the adjusted income.