Epf Contribution Table 2019 Pdf

With this 172 categories of industries establishments out of 177 categories notified were to pay provident fund contribution 10 w e f.

Epf contribution table 2019 pdf. All employers in the private sector whose employees are covered under the act are required to pay contributions on behalf of their employees. Online withdrawal application via i akaun has now been extended to age 50 years 55 years 60 years and withdrawal for savings more than rm 1 million. Exempted for federal and state government permanent employees domestic servant and self employed. The contribution rate is based on section 18 and schedule 2 of the employment insurance system act 2017.

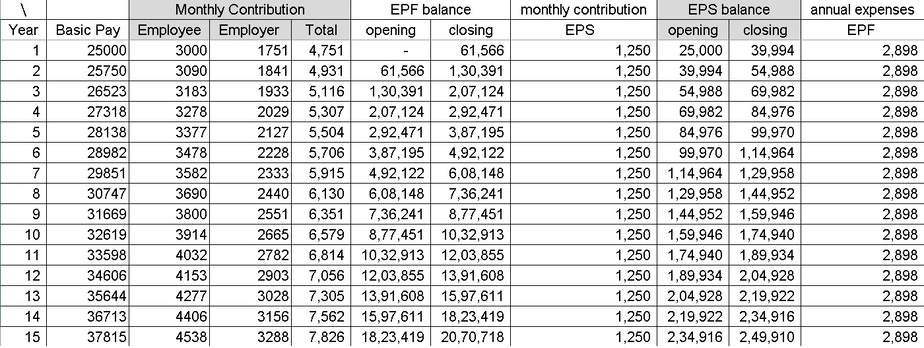

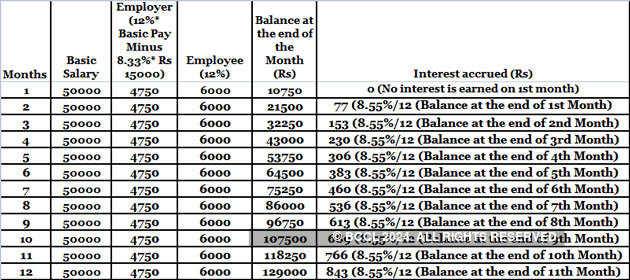

Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule. Third schedule subsection 43 1 rate of monthly contribution part a the rate of monthly contribution specified in this part shall apply to a employees who are malaysian citizens. Settlement of death claims on priority basis in events of industrial accidents etc. 22 09 1997 onwards 10 enhanced rate 12.

The employees provident fund act 1991 is amended by substituting for the third schedule the following schedule. A 31011 1 2020 exam 14 dated 20 07 2020 256 5kb 41. The minimum employers share of epf statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the employees share of contribution rate will be zero per cent. Employers are required to remit epf contributions based on this schedule.

Notification dated 9th april 1997 was issued enhancing provident fund contribution rate from 8 33 to 10. Cpf contribution and allocation rates p cpf contributions are payable at the prevailing cpf contribution rates for your employees who are singapore citizens and singapore permanent residents spr p. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12. Amaun upah bagi bulan itu kadar caruman bagi bulan itu oleh oleh jumlah majikan pekerja caruman rm rm rm rm rm dari 1 320 01 hingga 1 340 00 175 00 148 00 323 00.

Edli 3 39 som 2020 246 dated 17 07 2020 243 8kb 40.