Best Retirement Plan Malaysia 2020

3 best retirement plans in singapore in terms of coverage guaranteed returns and flexibility.

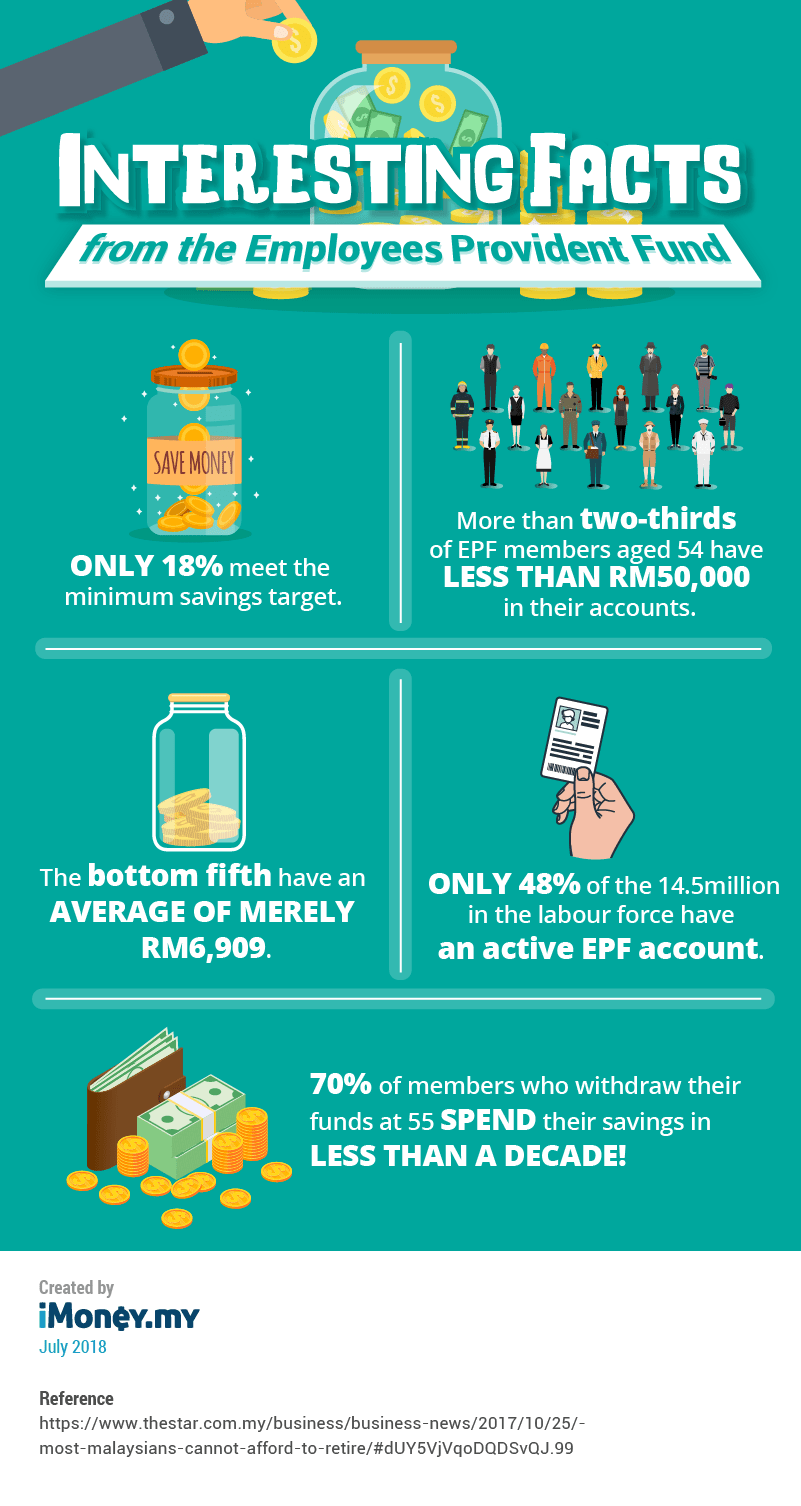

Best retirement plan malaysia 2020. Last year the employees provident fund epf raised the minimum savings target to rm228 000 by the age of 55. Cpf life makes a good retirement plan in the sense that you get a fixed amount of pay out each month following retirement. In short if you want the best retirement lifestyle and sustainability you will love this guide. Use our private retirement calculator to determine how much much you need to safe through the years to have good financially secured retirement.

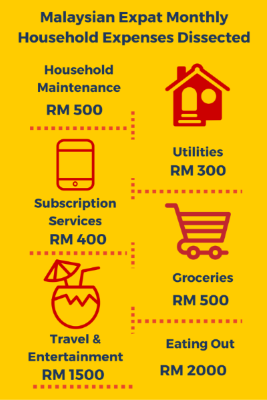

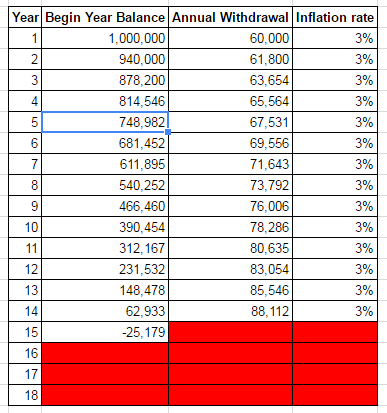

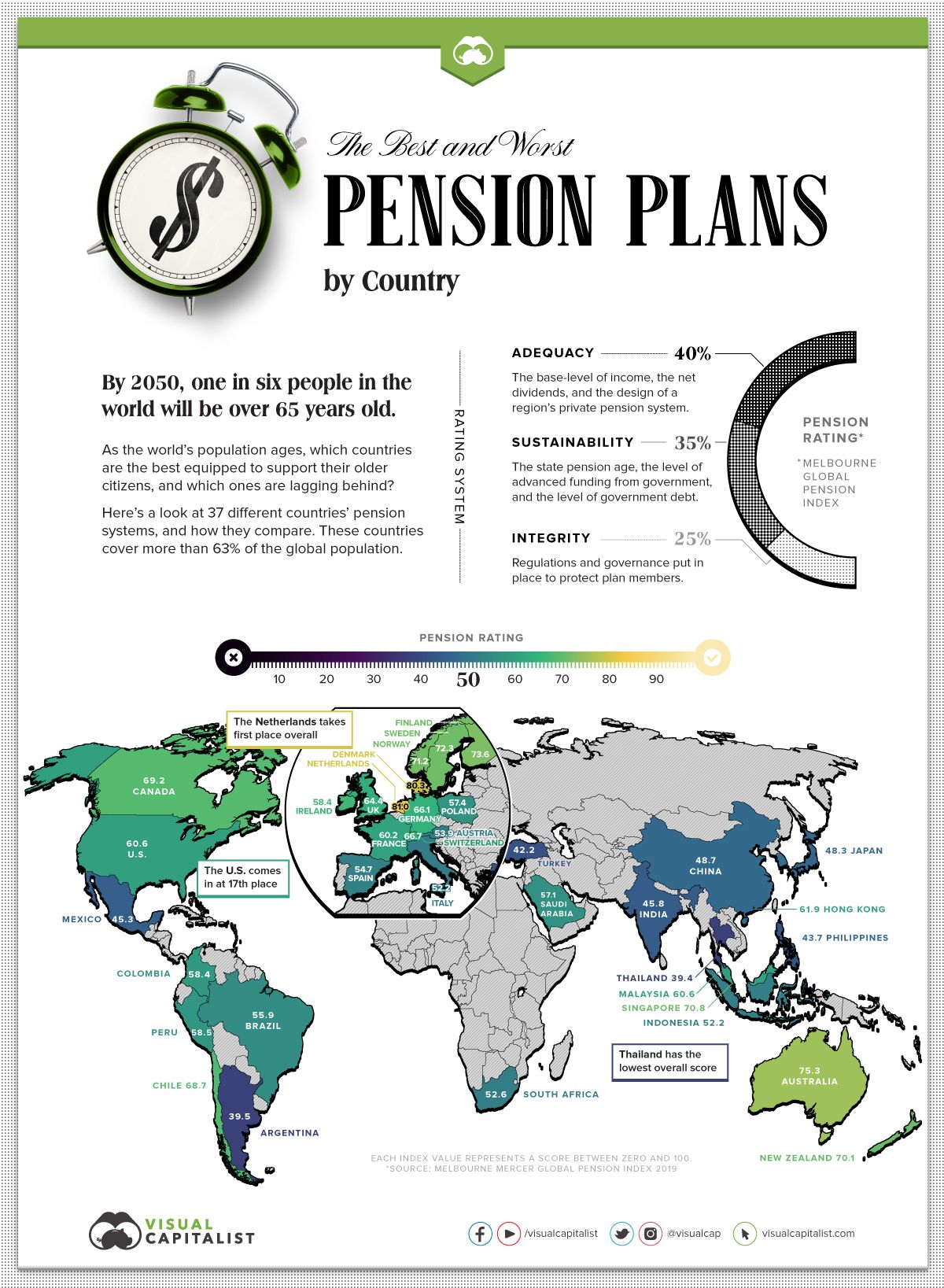

So is your retirement fund sufficient. Best private retirement schemes malaysia 2020 imoney my. This means a monthly retirement income of the only rm950 per month assuming a life expectancy of 75 years old. No less than 12 factors are taken into account when assessing potential destinations such as cost of living political life retirement benefits malaysia climate and healthcare all based on a couple of retirees living with at least 1 500 per month.

Pensions and 401k are two popular methods for retirement plans with the main difference being that pensions are a defined benefit plan and 401ks are a defined contribution plan. Every middle class earner destined for decent retirement featured in starbiz the star on 30th may 2015. Best retirement plan malaysia. A retirement plan is a savings and investment plan that provides income during retirement.

This type of individual retirement account ira is funded with your taxed dollars so you can enjoy tax free growth and withdrawals. 61 to 90 years old. It is created by insurance companies with a defined benefit. The 3 best rated retirement plan providers in 2020 if you have access to a workplace retirement plan like a 401 k consider yourself fortunate and then make sure you are maxing out any.

It s typically recommended as an additional retirement plan to one of the defined contribution plans 401k 403b 457 or tsp to balance the pre tax and after tax benefits. Review of best 3 retirement plans in singapore. However the amount of pay out may not be adequate to fulfil one s retirement lifestyle aspirations. A pension will pay out regular payments once you retire until you die whereas a 401k account can be accessed after retirement as needed.

For example an insurance company can say that if you pay them x amount of dollars from now till you are age 55 they are going to give you a guaranteed monthly income of y dollars from your age 60 to 80 years old. 41 to 50 years. With all the talk revolving around the epf withdrawal age lately the topic of the best retirement plan in malaysia seems to be on the tip of everybody s tongue.