Basic Islamic Banking Concept

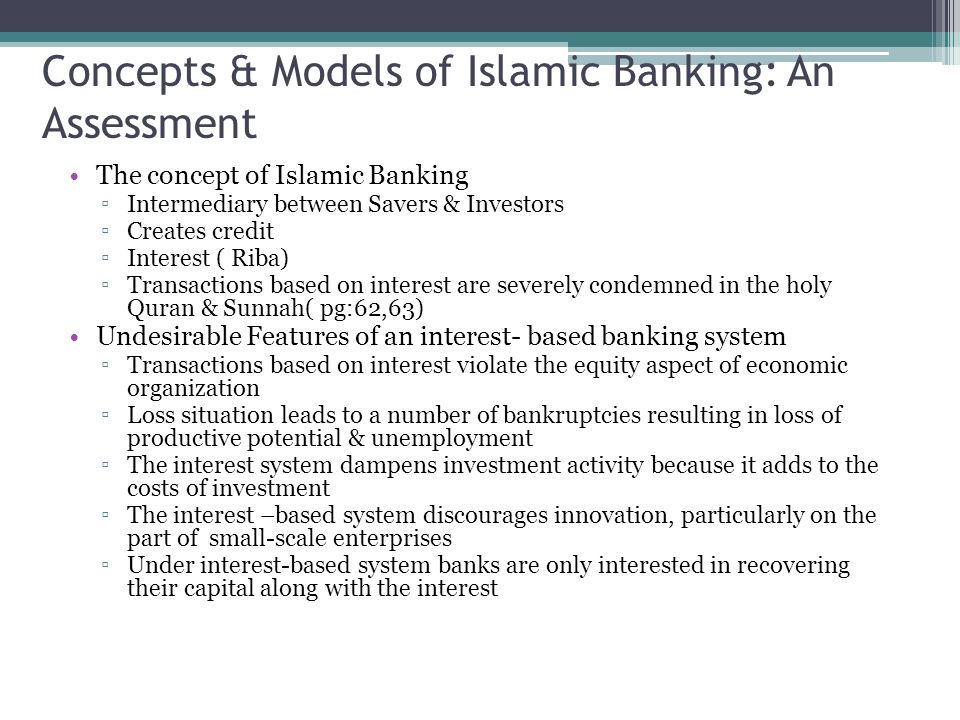

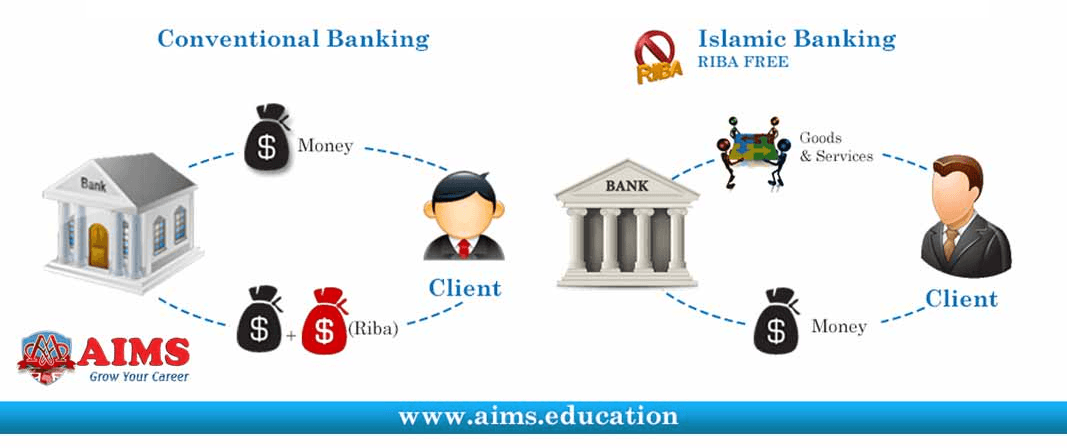

It endorses on interest free debt and denies effortless profit as it is regarded as premium or interest and curse in islam islamic banking in usa.

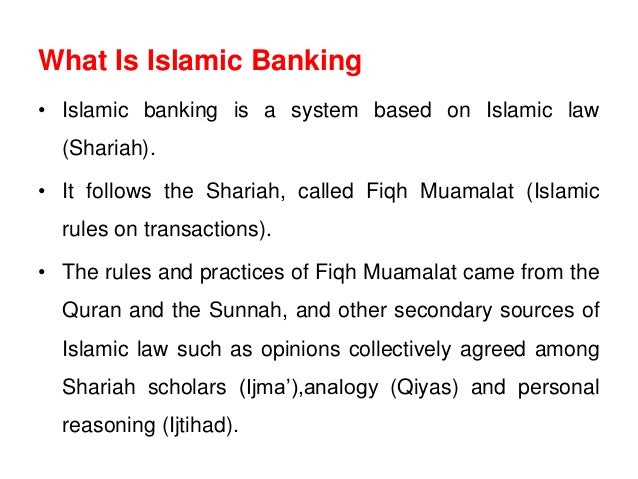

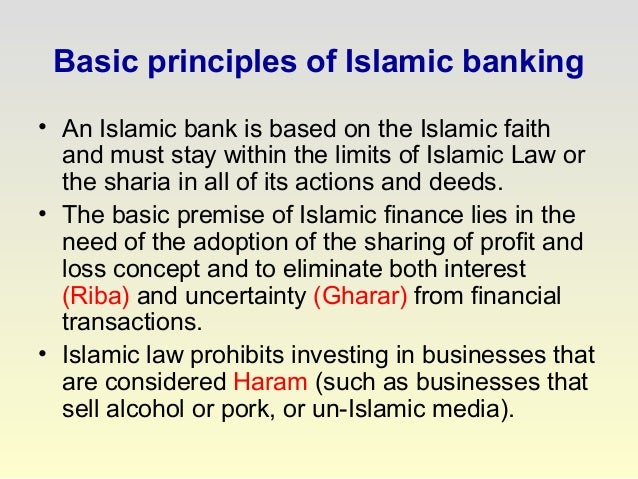

Basic islamic banking concept. Banking in islam is a saving money framework that depends on the standards of islamic law additionally known as shariah law and guided by islamic financial matters. Sharia forbids the fixed or floating payment or acceptance of specific interest rates or fees known as riba. Islamic banking or islamic finance arabic. Balancing material pursuits and spiritual needs.

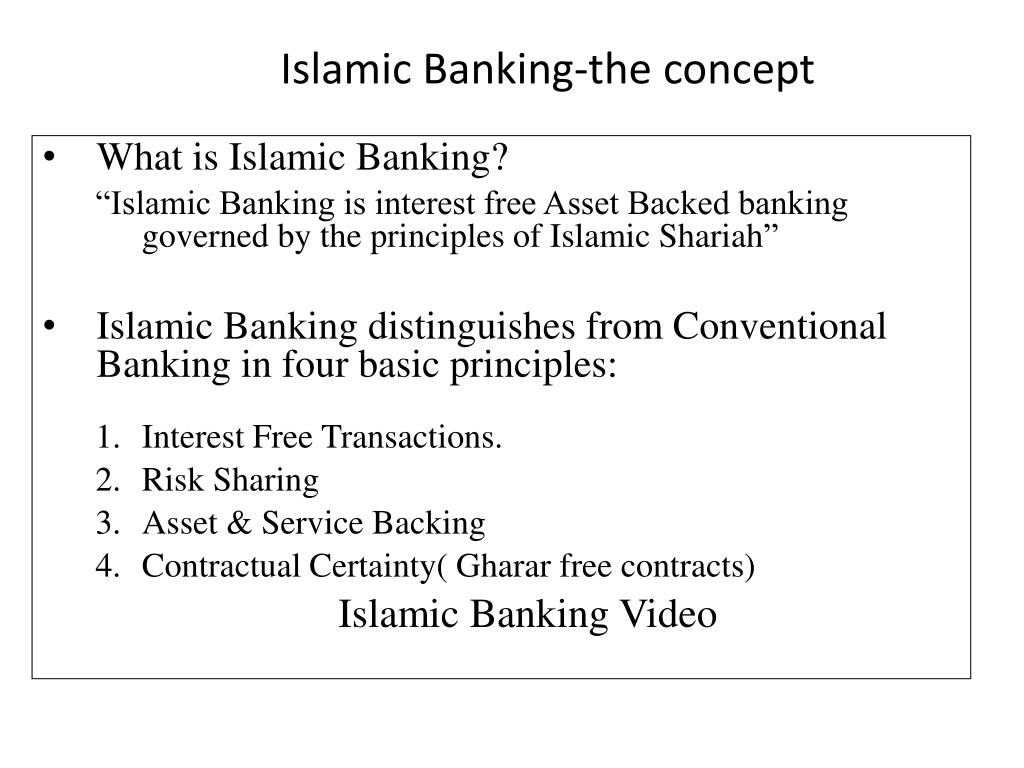

The basic principle of islamic banking is based on risk sharing. While a basic tenant of islamic banking the outlawing of riba a term that encompasses not only the concept of usury but also that of interest has seldom been recognised as applicable beyond the islamic world many of its guiding principles have. Learn more about the concept of an open market. Mudharaba according to jurists is a social contract whereby.

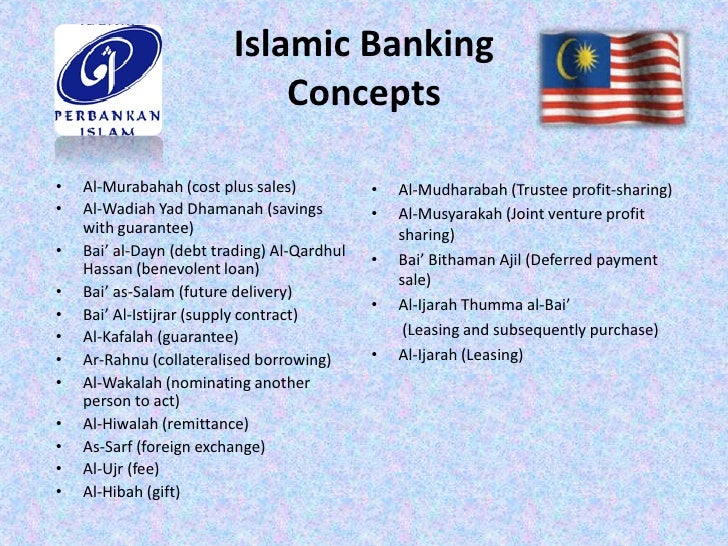

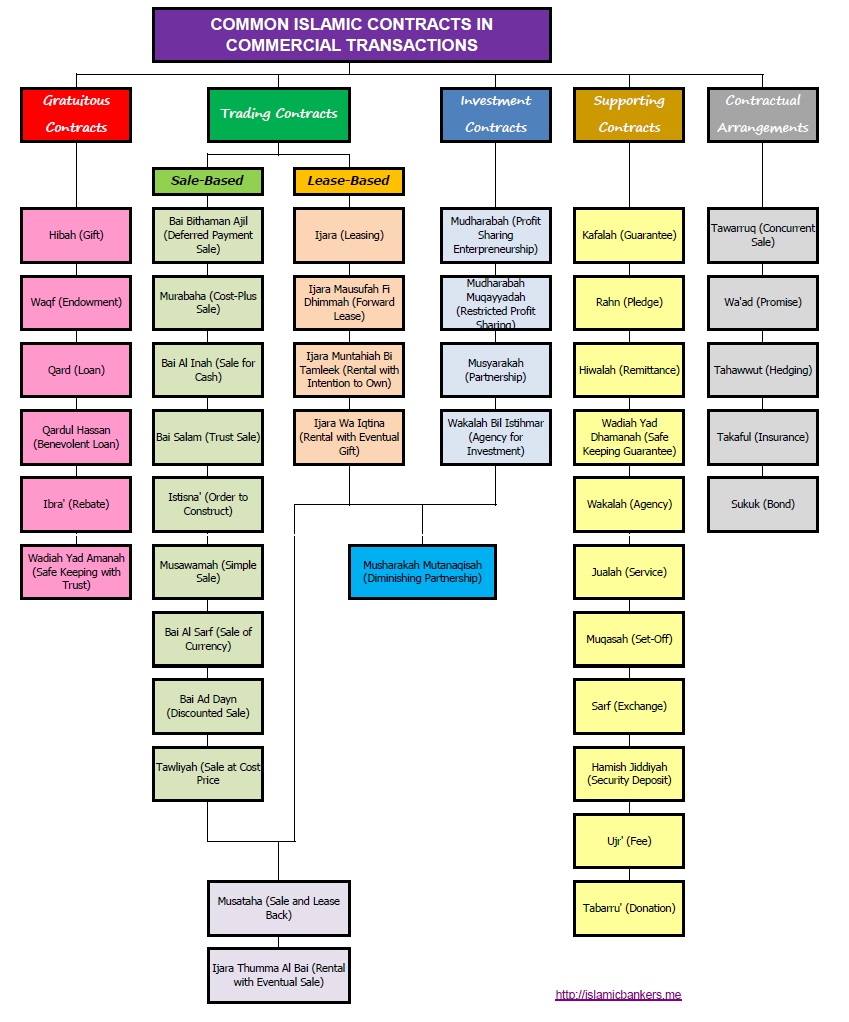

مصرفية إسلامية or sharia compliant finance is banking or financing activity that complies with sharia islamic law and its practical application through the development of islamic economics some of the modes of islamic banking finance include mudarabah profit sharing and loss bearing wadiah safekeeping musharaka joint. Dr shawki ismail shehta viewing the concept from perspective of an islamic economy and the prospective role to be played by an islamic bank therein opines that it is therefore natural and indeed imperative for an islamic bank incorporate in its functions and practices commercial investment and social activities an institution design to promote the civilized mission of an islamic economy. Established in the form of a loan of a specific amount although in some cases there are also options for the opening of mortgage loans that can be used by withdrawals within a total ceiling granted by a bank or specialized financial institution. Islamic banking is a banking system that is based on the principles of islamic law sharia law and guided by islamic economics.

The basic concept on which earlier islamic banking functions depended and flourished was mudharaba. Islamic banking principles. The main concept of the islamic banking is the prohibition on collection of interest and its utilization for the business purposes. Basic concepts of islamic banking.

Following are some basic concepts of islamic banking system. In islam economic activity conducted according to sharia is itself an act of worship. Islamic economics is based on core concepts of balance which help ensure that the motives and objectives driving the islamic finance industry are beneficial to society. This is viewed as a component of trade as opposed to a risk transfer which is how conventional banking is regarded.

:max_bytes(150000):strip_icc()/PROJECT-DEVELOPER-9bddde300c994be3871dd9790d15f7bb.jpg)